GST Reforms: Boosting Growth and Competitiveness for Andhra Pradesh

GST Reforms: Boosting Growth and Competitiveness for Andhra Pradesh

Key Takeaways

Introduction

From the fishing harbours of Visakhapatnam and the auto hubs of Anantapur and Chittoor to the coffee plantations of Araku Valley and the craft clusters of Kondapalli and Etikoppaka, Andhra Pradesh’s economy reflects a unique blend of traditional livelihoods and modern industry. The recent GST rate rationalisation provides broad-based relief across this spectrum.

Lower tax rates will bring down costs for consumers, ease working capital for MSMEs, and expand market competitiveness for exporters. The impact will be visible across fisheries, dairy, automobiles, pharmaceuticals, medical devices, renewable energy, handicrafts, and everyday essentials. By reaching both households and industries, the reforms are expected to support millions of livelihoods, reduce the cost of living, and open fresh opportunities for growth across rural and urban Andhra Pradesh.

Fisheries and Coastal Economy

Andhra Pradesh contributed 41% of India’s fish production in 2022–23 and the sector accounts for 7.4% of the state’s GSDP. Spread across nine coastal districts such as East Godavari, West Godavari, Guntur, Krishna, Nellore, Prakasam, Srikakulam, Visakhapatnam and Vizianagaram, it sustains around 14.5 lakh people, including large numbers of women engaged in cleaning, processing and cooperatives.

With GST reduced from 12/18% to 5% on fish oils, extracts, preserved products, fishing gear, diesel engines, pumps, aerators and key chemicals, input costs will decline, easing the burden on small processors and traditional fishing communities. Andhra Pradesh also contributes over 30% of India’s seafood exports, shipped mainly from Visakhapatnam Port to markets such as the USA (34.5%), China (25.3%), the EU, Southeast Asia and the Middle East. These reforms will improve affordability, boost competitiveness in global trade, and strengthen livelihoods along the state’s coastline.

Dairy

Ranked 4th nationally in milk production, the state supports 24 lakh farmers, many of them women in self-help groups and cooperatives. Major brands like Heritage and Vijaya anchor collection, chilling, processing and retail networks across the state.

With GST reduced from 5% to 0% on UHT milk and paneer, from 12% to 5% on ghee and butter, and from 18% to 5% on ice-cream, processed dairy products are now 5–7% cheaper. This will lower household costs, boost festive-season demand, and strengthen income opportunities for dairy farmers and SHG-led cooperatives in districts such as Krishna, Srikakulam, West Godavari, East Godavari, Guntur, Chittoor and Vizianagaram.

Andhra’s dairy market, valued at ₹713.9 billion in 2024, is projected to nearly double by 2033, making these tax cuts especially timely for a rapidly expanding sector.

Automobiles and Auto Components

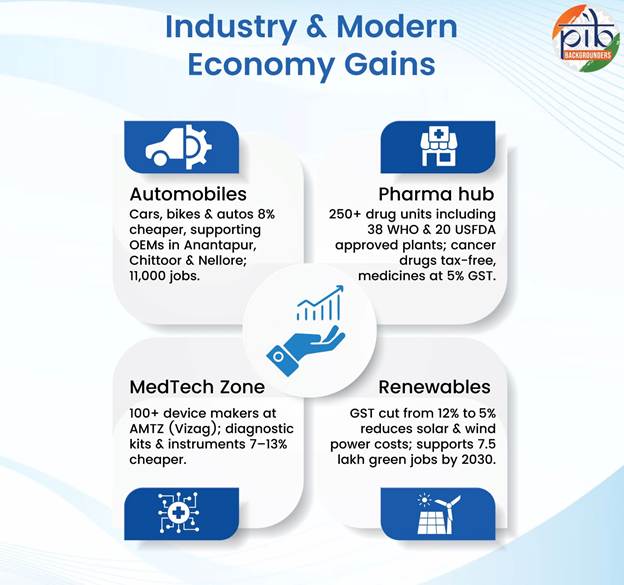

Andhra Pradesh has emerged as a key auto hub, with major plants of Kia, Isuzu, Hero and Ashok Leyland alongside over 100 auto-component MSMEs in districts such as Anantapur, Chittoor, Visakhapatnam and Nellore. The sector employs more than 11,000 people (about 4,000 direct and 7,000 indirect jobs), including skilled technicians, ITI diploma holders and engineers.

With GST reduced from 28% to 18% on three-wheelers, small cars and motorcycles (up to 350cc engine capacity), and a uniform 18% rate applied on all auto parts, vehicles and spares are now around 8% cheaper. This eases affordability for consumers, reduces working capital pressures for OEMs, and strengthens the competitiveness of Andhra’s auto exports to Europe, the USA and South Korea.

Pharma & Life Sciences

The state is home to 250+ bulk drug and API units across Anakapalli, Visakhapatnam, Atchutapuram, Naidupeta and Pydibhimavaram, including 38 WHO-approved and 20 USFDA-approved facilities.The sector employs more than 89,000 highly skilled workers, supporting both manufacturing and R&D.

GST cuts from 12% to nil on 30 cancer drugs, and from 12% to 5% on medicines for personal use, make healthcare more affordable across India. Global companies such as Dr Reddy’s, Aurobindo Pharma, GSK, Lupin and Biocon operate in the state, while exports, led by the USA (52%), South Africa and China, reinforce Andhra’s role as a pharma powerhouse. The tax cuts to improve accessibility for patients and strengthen the competitiveness of Andhra’s life sciences sector in global markets.

Medical Devices

Andhra Pradesh is home to the AP MedTech Zone (AMTZ) in Visakhapatnam, which houses over 100 manufacturing units producing medical devices, diagnostics and healthcare technologies. The sector generates high-skill employment in R&D, quality assurance and shop-floor roles, while serving a broad patient base across India.

With GST reduced from 18% to 5% on devices like thermometers and medical apparatus, and from 12% to 5% on surgical instruments, diagnostic kits and reagents, costs are now 7–13% lower. This makes healthcare more affordable and accessible for domestic patients, while strengthening Andhra Pradesh’s exports to over 80 countries, backed by global certifications such as US FDA, CE Marking and ISO.

Renewable Energy

With capacity growing more than seven-fold between 2014 and 2024, clusters in Kurnool, Kadapa and Anantapur have positioned the state as a front-runner in renewable energy adoption. Only 5.6% of its 167 GW potential has been tapped so far, leaving significant room for expansion.

With GST reduced from 12% to 5% on renewable energy devices, solar heaters, cookers and fuel cell vehicles, project costs are expected to decline. For instance, the cost of power generation could fall by about 10 paise per unit for solar projects and 15–17 paise per unit for wind projects, making renewable energy more viable, affordable and attractive for wider rural and urban uptake. This also strengthens the state’s goal of creating 7.5 lakh green jobs by 2030.

Handicrafts and GI Products

Araku Coffee

Cultivated by about 1.5 lakh tribal farmers in Alluri Sitharama Raju, Visakhapatnam and East Godavari districts, this GI-tagged Arabica coffee has built a strong domestic presence through specialty brands such as Blue Tokai, while also reaching export markets in Sweden, UAE, Italy and Switzerland. With GST reduced from 18% to 5%, retail prices are expected to fall, ensuring better value realisation for farmers and strengthening the value chain.

Etikoppaka & Kondapalli Toys

Traditional toy-making clusters in Anakapalli and NTR districts sustain thousands of cottage artisans. Recognised with GI tags (Kondapalli in 2006, Etikoppaka in 2017), these toys are sold as cultural and decorative items and also find a niche export market, particularly among the Indian diaspora. With GST reduced from 12% to 5%, toys are now 6–7% cheaper, boosting affordability during festivals like Navaratri Golu and enhancing export competitiveness.

Leather Puppetry

Practiced by the Marathi Balija community in Anantapur, Guntur and Nellore, this hereditary craft has been GI-tagged since 2008. Traditionally seasonal, aligned with temple events and festivals, artisans now diversify into lampshades, wall hangings and souvenirs for year-round income. With GST reduced from 12% to 5%, finished pieces are about 6% cheaper, strengthening artisan incomes through handicraft fairs and emporia sales.

Stone Carvings

The Durgi cluster (Guntur), GI-tagged in 2017, sustains fewer than 50 sculptor families of Viswa Brahmin craftsmen.

Meanwhile the Allagadda cluster (Nandyal), GI-tagged in 2018, employs over 1,000 artisans from hereditary Shilpi and Viswakarma families. Products include temple idols, household décor and collector pieces, with exports to the USA, China and Sri Lanka, including notable buyers such as the Sri Venkateswara Temple in Pittsburgh. With GST reduced from 12% to 5%, prices are now about 6% lower, supporting domestic temple demand and expanding niche export markets.

Conclusion

The GST reforms are expected to bring widespread relief across Andhra Pradesh, touching the lives of coastal fishing families, dairy farmers, auto workers, pharma and medtech professionals, renewable energy technicians, artisans and middle-class households. Everyday essentials like milk, medicines, soaps, notebooks and two-wheelers are expected to become more affordable, while strategic sectors such as automobiles, pharmaceuticals, renewables and handicrafts are expected to gain fresh competitiveness.

Together, these changes are expected to lower costs, boost demand and strengthen export potential, helping sustain diverse livelihoods while easing the burden on households. Andhra Pradesh now stands to consolidate its place as a dynamic hub of both traditional strengths and modern industries, aligned with the vision of Atmanirbhar Bharat and Viksit Bharat 2047.