Ministry of Finance Year Ender 2024: Department of Revenue

Ministry of Finance Year Ender 2024: Department of Revenue

Measures for Facilitation of Trade

Exchange Rate Automation Module:

· Indian Customs has always been at the forefront when it comes to adopting cutting edge technology for providing better services. In this regard, Board has launched the Exchange Rate Automation Module and the modalities has been explained in Circular 07/2024-Customs dated 25.06.2024 and its amendment Circular No. 17/2024-Customs dated 18.09.2024. The exchange rates shall be published on ICEGATE website at 6:00 p.m. twice a month (i.e. 1st & 3rd Thursdays of every month) and shall be accessible for public viewing on ICEGATE website. Thus, the automated system has now replaced the manual process of publication of exchange rates.

Encouraging Women participation in International Trade:

The Zones have been instructed by the Board Circular No. 2/2024-Customs, dated March 8, 2024 to promote women’s representation and support within customs and trade activities by:

Mandatory additional qualifiers in import/export declarations in respect of Synthetic or Reconstructed Diamonds w.e.f., 01.12.2024:

Extended export related benefits for exports made through courier mode:

In the year 2024, the Central Board of Direct Taxes (CBDT) and Central Board of Indirect taxes and Customs (CBIC), under the Department of Revenue, Ministry of Finance, have continued their citizen-centric initiatives, driving significant reforms to enhance taxpayer experience.

The CBDT maintained its focus on taxpayer outreach and assistance through active helpdesks and embraced faceless processes, reinforcing its commitment to transparency and efficiency. Speedy processing of returns and refunds remained a priority, with over Rs. 2.35 lakh crore refunded and more than 3.87 crore Income Tax Returns (ITRs) processed within 7 days. Innovations like TIN 2.0, pre-filling of ITRs, and updated returns continued to streamline processes, resulting in 47.52 lakh updated returns filed.

The CBIC continued to review and reform initiatives towards enhancing the efficiency and integrity of the Goods and Services Tax (GST) system in its seventh year. The CBIC leveraged advanced data analytics and artificial intelligence to further strengthened its registration processes by refining the risk rating system for applicants, ensuring rigorous verification to prevent fraud. Initiatives such as geo-tagging of business locations, system-based suspension of registrations for non-filers, and risk-based refund processing continued to demonstrate CBIC’s commitment to curbing malpractices.

To simplify compliance, the sequential filing of GSTR-1 and GSTR-3B was enforced, promoting timely returns and seamless availability of input tax credits. Special drives against fake registrations, automated intimation of mismatches, and a dedicated functionality for unregistered persons to apply for temporary registrations highlighted CBIC’s proactive compliance measures.

Additionally, initiatives supporting businesses included the transfer of balances in electronic cash ledgers, exemptions for small taxpayers, and facilitation of intra-state supply through e-commerce operators. The extension of GST exemptions for satellite launch services and further simplification of late fee structures were also noteworthy.

On the Customs front, the CBIC introduced regulatory and policy reforms, such as rationalisation of Customs duty rates and steps toward decriminalisation. Technological advancements like ICEGATE 2.0 and the Anonymised Escalation Mechanism continued to modernise tax administration. Infrastructural upgrades, including pre-gate processing facilities and modernisation of control laboratories, enhanced operational efficiency. These efforts collectively reinforced CBIC’s commitment to transparency, Ease of Doing Business, and robust compliance frameworks in the year 2024.

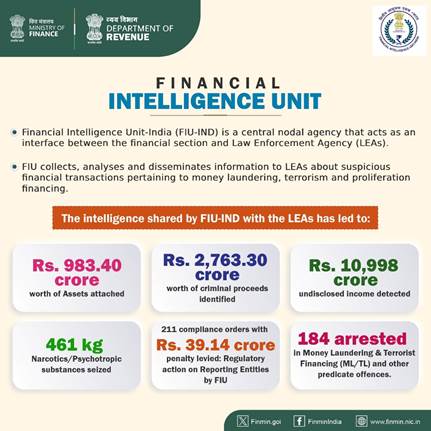

Besides these, the Department of Revenue also continued to contribute towards strengthening financial intelligence gathering and enabling enforcement through multiple measures. One major highlight of the FIU was India achieving a high-level of technical compliance across the Financial Action task Force (FATF) recommendations to tackle illicit finance.

Major achievements of 2024 by Financial Intelligence Unit (FIU) under the Department of Revenue, Ministry of Finance.

The intelligence shared by FIU-IND with the LEAs has led to:

FATF PLACES INDIA IN ITS HIGHEST CATEGORY

BROAD ACHIEVEMENTS UNDER THE CENTRAL BOARD OF DIRECT TAXES (CBDT) IN 2024:

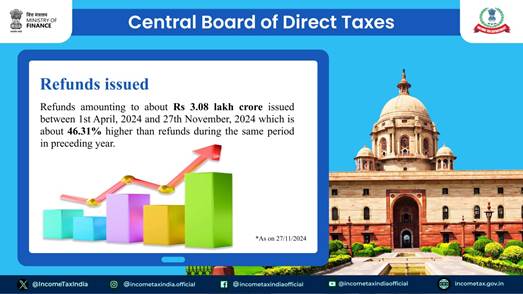

REFUNDS ISSUED

Refunds amounting to about Rs 3.08 lakh crore issued between 1st April, 2024 and 27th November, 2024 which is about 46.31% higher than refunds during the same period in preceding year.

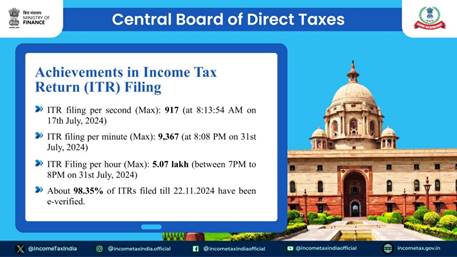

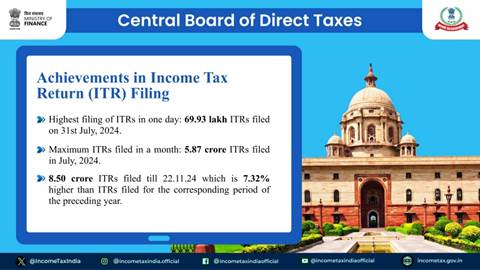

ACHIEVEMENTS IN INCOME TAX RETURN (ITR) FILING

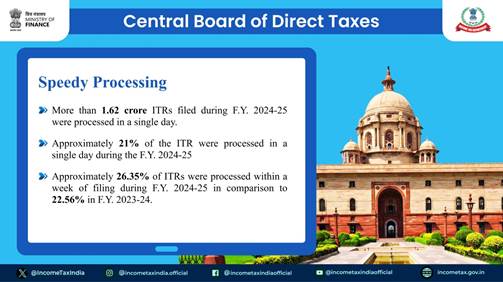

SPEEDY PROCESSING

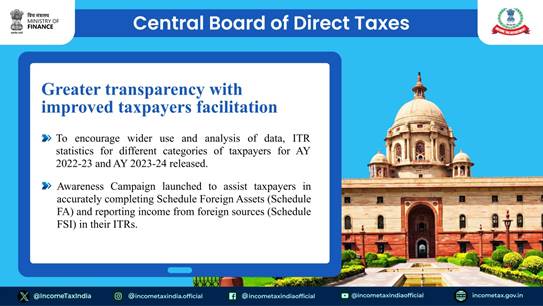

GREATER TRANSPARENCY WITH IMPROVED TAXPAYER FACILITATION

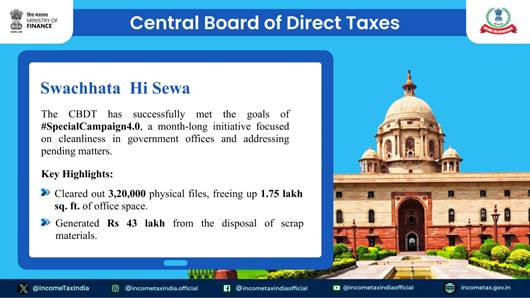

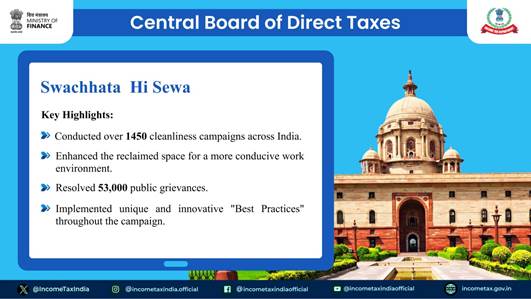

SWACHHATA HI SEWA

The CBDT has successfully met the goals of #SpecialCampaign4.0, a month-long initiative focused on cleanliness in government offices and addressing pending matters.

Key Highlights:

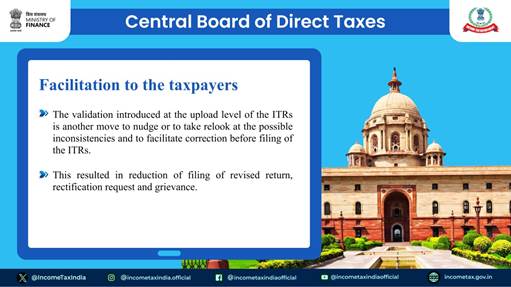

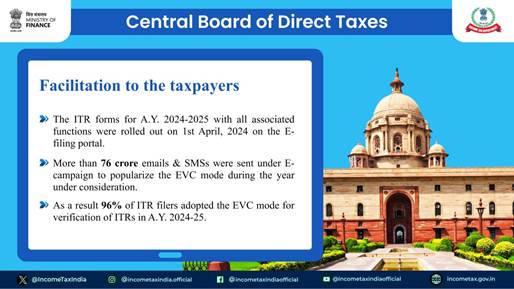

FACILITATION TO THE TAXPAYERS

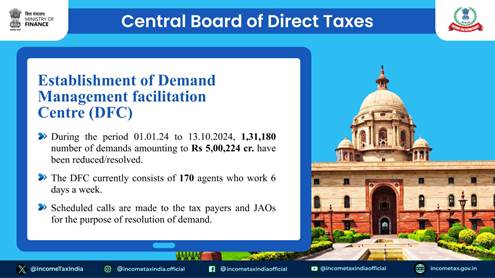

ESTABLISHMENT OF DEMAND MANAGEMENT FACILITATION CENTRE (DFC)

BROAD ACHIEVEMENTS UNDER THE CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS(CBIC) IN 2024:

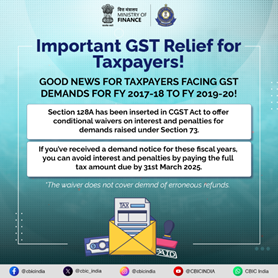

GOODS AND SERVICES TAX (GST)

Recent measures for simplification, trade facilitation and Ease of Doing Business under GST:

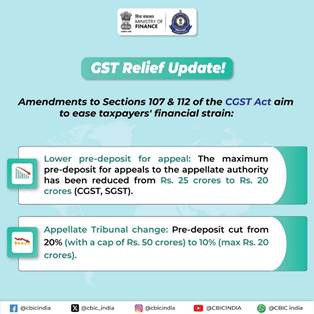

· Amendment in Section 107 and Section 112 of CGST Act for reducing the amount of pre-deposit required to be paid for filing of appeals under GST: Provisions have been made for reducing the amount of pre-deposit for filing of appeals under GST to ease cash flow and working capital blockage for the taxpayers. The maximum amount for filing appeal with the appellate authority has been reduced from Rs. 25 crores CGST and Rs. 25 crores SGST to Rs. 20 crores CGST and Rs. 20 crores SGST. Further, the amount of pre-deposit for filing appeal with the Appellate Tribunal has been reduced from 20% with a maximum amount of Rs. 50 crores CGST and Rs. 50 crores SGST to 10 % with a maximum of Rs. 20 crores CGST and Rs. 20 crores SGST.

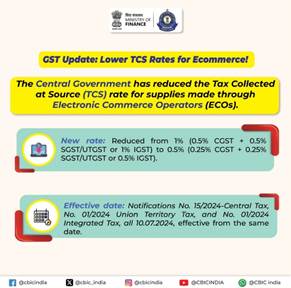

Reduction in rate of TCS to be collected by the ECOs for supplies being made through them: Electronic Commerce Operators (ECOs) are required to collect Tax Collected at Source (TCS) on net taxable supplies under Section 52(1) of the CGST Act. The Central Government has issued Notification No. 15/2024-Central Tax dated 10.07.2024 (notified w.e.f. 10.07.2024), Notification No. 01/2024-Union Territory Tax dated 10.07.2024 (notified w.e.f. 10.07.2024) & Notification No. 01/2024-Integrated Tax dated 10.07.2024 (notified w.e.f. 10.07.2024) to reduce the TCS rate from present 1% (0.5% CGST + 0.5% SGST/ UTGST, or 1% IGST) to 0.5 % (0.25%

Reduction in rate of TCS to be collected by the ECOs for supplies being made through them: Electronic Commerce Operators (ECOs) are required to collect Tax Collected at Source (TCS) on net taxable supplies under Section 52(1) of the CGST Act. The Central Government has issued Notification No. 15/2024-Central Tax dated 10.07.2024 (notified w.e.f. 10.07.2024), Notification No. 01/2024-Union Territory Tax dated 10.07.2024 (notified w.e.f. 10.07.2024) & Notification No. 01/2024-Integrated Tax dated 10.07.2024 (notified w.e.f. 10.07.2024) to reduce the TCS rate from present 1% (0.5% CGST + 0.5% SGST/ UTGST, or 1% IGST) to 0.5 % (0.25%

CGST + 0.25% SGST/UTGST, or 0.5% IGST), to ease the financial burden on the suppliers making supplies through such ECOs.

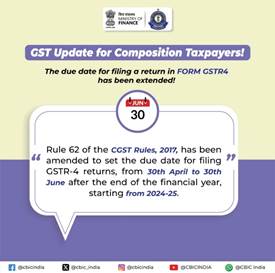

· Change in due date for filing of return in FORM GSTR-4 for composition taxpayers from 30th April to 30th June: Amendments have been done in clause (ii) of sub-rule (1) of Rule 62 of CGST Rules, 2017 and FORM GSTR- 4 to extend the due date for filing of return in FORM GSTR-4 for composition taxpayers from 30th April to 30th June following the end of the financial year. This will apply for returns for the financial year 2024-25 onwards. The same would give more time to the taxpayers who opt to pay tax under composition levy to furnish the said return.

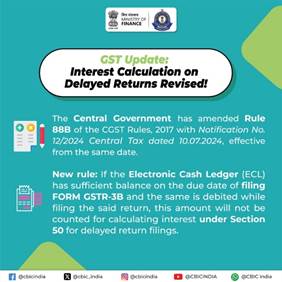

Amendment of Rule 88B of CGST Rules, 2017 in respect of interest under Section 50 of CGST Act on delayed filing of returns, in cases where the credit is available in Electronic Cash Ledger (ECL) on the due date of filing the said return:-The Central Government has issued Notification No. 12/2024-Central Tax dated 10.07.2024 for amendment in rule 88B (w.e.f. 10.07.2024) of CGST Rules to provide that an amount which is available in the Electronic Cash Ledger on the due date of filing of return in FORM GSTR-3B, and is debited while filing the said return, shall not be included while calculating interest under section 50 of the CGST Act in respect of delayed filing of the said return. This will reduce interest burden on such taxpayers.

Amendment of Rule 88B of CGST Rules, 2017 in respect of interest under Section 50 of CGST Act on delayed filing of returns, in cases where the credit is available in Electronic Cash Ledger (ECL) on the due date of filing the said return:-The Central Government has issued Notification No. 12/2024-Central Tax dated 10.07.2024 for amendment in rule 88B (w.e.f. 10.07.2024) of CGST Rules to provide that an amount which is available in the Electronic Cash Ledger on the due date of filing of return in FORM GSTR-3B, and is debited while filing the said return, shall not be included while calculating interest under section 50 of the CGST Act in respect of delayed filing of the said return. This will reduce interest burden on such taxpayers.

Provision of new optional facility for taxpayers to amend the details in GSTR-1: The Central Government has provided for a new optional facility by way of FORM GSTR-1A (w.e.f. 10.07.2024) to facilitate the taxpayers to amend the details in FORM GSTR-1 for a tax period and/ or to declare additional details, if any, before filing of return in FORM GSTR-3B for the said tax period. This will facilitate taxpayer to add any particulars of supply of the current tax period missed out in reporting in FORM GSTR-1 of the said tax period or to amend any particulars already declared in FORM GSTR-1 of the current tax period (including those declared in IFF, for the first and second months of a quarter, if any, for quarterly taxpayers), to ensure that correct liability is auto-populated in FORM GSTR-3B.

Provision of new optional facility for taxpayers to amend the details in GSTR-1: The Central Government has provided for a new optional facility by way of FORM GSTR-1A (w.e.f. 10.07.2024) to facilitate the taxpayers to amend the details in FORM GSTR-1 for a tax period and/ or to declare additional details, if any, before filing of return in FORM GSTR-3B for the said tax period. This will facilitate taxpayer to add any particulars of supply of the current tax period missed out in reporting in FORM GSTR-1 of the said tax period or to amend any particulars already declared in FORM GSTR-1 of the current tax period (including those declared in IFF, for the first and second months of a quarter, if any, for quarterly taxpayers), to ensure that correct liability is auto-populated in FORM GSTR-3B.

A consolidated guidelines dated 30.03.2024 were issued to all CGST Zones in respect of Ease of Doing Business (EODB) to be followed during investigations of cases against regular taxpayers

A consolidated guidelines dated 30.03.2024 were issued to all CGST Zones in respect of Ease of Doing Business (EODB) to be followed during investigations of cases against regular taxpayers

Besides, based on the recommendations of the GST Council, a large number of notifications and circulars have been issued on contentious issues, so as to avoid legal disputes.

Besides, based on the recommendations of the GST Council, a large number of notifications and circulars have been issued on contentious issues, so as to avoid legal disputes.

RECOMMENDATIONS OF THE 55th GST COUNCIL MEETING

https://pib.gov.in/PressReleasePage.aspx?PRID=2086873

RECOMMENDATIONS OF THE 54thGST COUNCIL MEETING

Recommendations Relating to GST Rates on Goods:

Duties & Exemptions

RECOMMENDATIONS OF THE 53rd GST COUNCIL MEETING

Recommendations Relating to GST Rates on Goods

CUSTOMS

Budget 2024-25- major announcements:

Issuance of Instruction No. 06/2024-Customs dt. 23.03.24

· Smooth and fair elections require coordinated and focused attention, including proper sharing of information by various LEA’s. To this effect, vide Instructions No. 06/2024-Customs dt. 23.03.24 a detailed Standard Operating Procedure was issued for all formations under CBIC to curb the flow of suspicious cash, illicit liquor, drugs/narcotics, freebies and smuggled goods during elections. It includes instructions regarding reporting of major seizures (more than Rs.1 crore) during election & implementation of ESMS for reporting interceptions/seizures made by various enforcement agencies on real-time basis.

Handing over of Antiquities seized by Customs to ASI

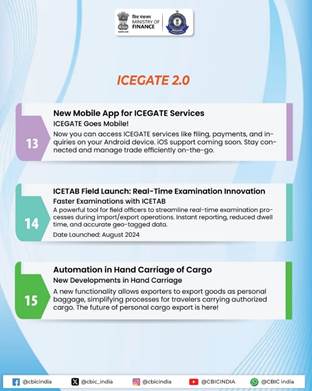

Indian Customs Electronic Commerce/Electronic Data Interchange (ICEGATE) 2.0:

USE of ICETABs for efficient examination and clearance process:

This initiative highlights the importance of gender equality in trade (be it as traders, customs house agents, freight forwarders, or customs brokers) advocating for active efforts from Partner Government Agencies and trade bodies to support the increasing participation of women across various roles in the logistics sector. The detailed guidelines for encouraging Women participation in International Trade are outlined in CBIC Circular No. 2/2024-Customs dated 08.03.2024.

Disbursal of Drawback amounts into the exporters’ account through PFMS:

Digitization of Customs Bonded Warehouse procedures relating to obtaining Warehouse License, Bond to Bond Movement of warehoused goods, and uploading of Monthly Returns:

Performance of ongoing schemes/ programs:

Provisioning services to SEZ Units at ICEGATE:

Launch of module for SCMTR (Sea Cargo Manifest and Transhipment Regulations):

The SCMTR also specifies changes to the formats and timelines for filing manifest declarations. Some of the features of the SCMTR include:

Document Download Utility:

Revamp of ICEGATE 2.0 Website:

AI-based interactive Chatbot (Vaani):

Exchange Rate Automation Module:

Tracking the details of NOC/Release Order Issuance details from the PGAs

API integration with Custodians (Sea and Land):

Integration with Department of Post:

IGST Refund for Export through Dak Niryat Kendra (DNK):

Integration with ECCS for SB filing, Custodian Registration and Message Exchange with ICEGATE:

Export benefits (RoDTEP, RoSCTL & Drawback) to goods exports through Courier mode:

Warehouse Licensing Code, Warehouse to warehouse goods movement and digitizing the monthly return for warehouse:

Launch of Mobile Application for Internal and External Users over Android Platform:

Integration with FSSAI, PQMS, AQCS under Single Sign On services:

Integration with BIS:

Integration with DGFT for RCMC details:

Export benefits to courier

IGST Refund for DAK Niryat

Post EGM Amendment Module

Hand carriage of cargo

ICETAB

Newly launched development

Upcoming development

- Rs. 983.40 crore worth of Assets attached

- Rs 2,763.30 crore worth of criminal proceeds identified

- Rs. 10,998 crore undisclosed income detected

- 461 kg Narcotics/Psychotropic substances seized

- 211 compliance orders with Rs 39.14 crore penalty levied: Regulatory action on Reporting Entities by FIU

- 184 arrested in Money Laundering and Terrorist Financing (ML/TL) and other predicate offences.