“Indian Telecom Services Performance Indicator Report” for the Quarter January-March, 2025

“Indian Telecom Services Performance Indicator Report” for the Quarter January-March, 2025

TRAI today has released the “Indian Telecom Services Performance Indicator Report” for the Quarter ending 31st March, 2025. This Report provides a broad perspective of the Telecom Services in India and presents the key parameters and growth trends of the Telecom Services as well as Cable TV, DTH & Radio Broadcasting services in India for the period covering 1st January, 2025 to 31st March, 2025 compiled mainly on the basis of information furnished by the Service Providers.

Executive Summary of the Report is enclosed. The complete Report is available on TRAI’s website (www.trai.gov.in and under the link http://www. trai.gov.in/release-publication/reports/performance-indicators-reports). Any suggestion or any clarification pertaining to this report, Shri Vijay Kumar, Advisor (F&EA), TRAI may be contacted on Tel. +91-20907773 and e-mail: advfea1@trai.gov.in.

The Indian Telecom Services Performance Indicators

January–March, 2025

Executive Summary

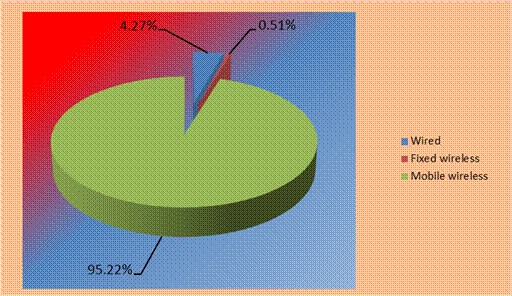

Composition of internet subscription

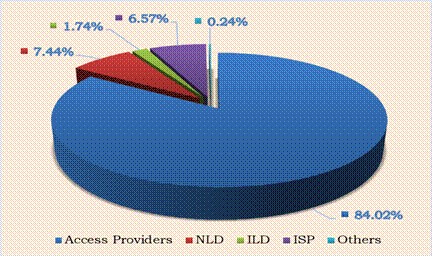

Service-wise composition of Adjusted Gross Revenue

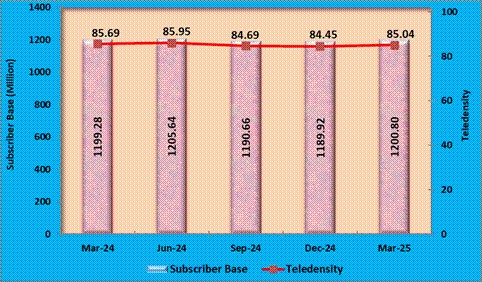

Trends in Telephone subscribers and Tele-density in India

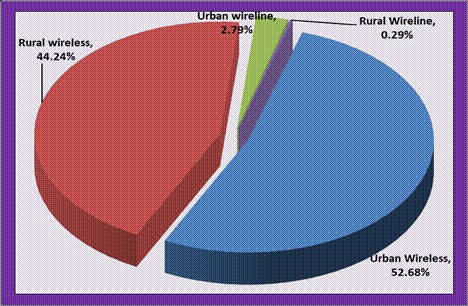

Composition of Telephone Subscribers

S. No.

Parameter

Benchmark

1

Point of Interconnection (POI) Congestion (90th percentile value)

≤ 0.5%

2

Accessibility of call centre/ customer care

≥ 95%

3

Percentage of calls answered by the operators (voice to voice) within 90 seconds

≥ 95%

4

Termination/ closure of service within seven working days of receipt of customer’s request

100%

S No.

Parameter

Benchmark

1

Cumulative downtime (Cells not available for service)

≤ 2%

2

Percentage of significant network outage (services not available in a district for more than 4 hours) reported to the Authority within 24 hrs of start of the outage

100%

3

Call Set-up Success Rate: Intra- Service provider (within service provider’s network)

≥ 98%

4

Call Set-up Success Rate: Inter- Service provider (incoming from other service providers’ network)

≥ 95%

5

Point of Interconnection (POI) Congestion (90th percentile value)

≤ 0.5%

6

DCR Spatial Distribution Measure for Circuit Switched (2G/3G) network [CS_QSD (88, 88)]

≤ 2%

7

Downlink Packet Drop Rate for Packet Switched Network (4G/5G and beyond) [DLPDR_QSD (88, 88)]

≤ 2%

8

Latency (in 4G and 5G network)

≤ 75 msec

9

Packet Drop Rate (in 4G and 5G network)

≤ 3%

10

Billing and charging complaints

≤ 0.1%

11

Application of adjustment to customer’s account within one week from the date of resolution of billing and charging complaints or rectification of faults or rectification of significant network outage, as applicable

100%

12

Termination/ closure of service within seven working days of receipt of customer’s request

100%

13

Refund of deposits within 45 days of closure of service or non-provisioning of service

100%

S. No.

Parameter

Benchmark

1

Latency

<=50msec

2

Packet Drop Rate

<=1%

3

Maximum Bandwidth utilization of any Customer serving node to ISP Gateway Node [Intra-network] or Internet Exchange Point Link(s)

<=80%

4

Jitter

≤ 40ms

5

Accessibility of call centre/ customer care

≥ 95%

SNAPSHOT

(Data as on Q.E. 31st March, 2025)

Telecom Subscribers (Wireless+Wireline)

Total Subscribers

1200.80 Million

% change over the previous quarter

0.91%

Urban Subscribers

666.11 Million

Rural Subscribers

534.69 Million

Market share of Private Operators

91.47%

Market share of PSU Operators

8.53%

Tele-density

85.04%

Urban Tele-density

131.45%

Rural Tele-density

59.06%

Wireless (Mobile+5G FWA) Subscribers

Wireless (Mobile) Subscribers

1,156.99 Million

Wireless (5G FWA) Subscribers

6.77 Million

Total Wireless Subscribers

1,163.76 Million

% change over the previous quarter

1.14%

Urban Subscribers

632.57 Million

Rural Subscribers

531.18 Million

Market share of Private Operators

92.09%

Market share of PSU Operators

7.91%

Tele-density

82.42%

Urban Tele-density

124.83%

Rural Tele-density

58.67%

Total Wireless Data Usage during the quarter

59,447 PB

Number of Public Mobile Radio Trunk Services (PMRTS)

67,023

Number of Very Small Aperture Terminals (VSAT)

2,43,663

Wireline Subscribers

Total Wireline Subscribers

37.04 Million

% change over the previous quarter

-5.67%*

Urban Subscribers

33.54 Million

Rural Subscribers

3.50 Million

Market share of PSU Operators

27.87%

Market share of Private Operators

72.13%

Tele-density

2.62%

Rural Tele-density

0.39%

Urban Tele-density

6.62%

No. of Public Call Office (PCO)

10,185

*Due to accounting of 5G–FWA subscribers in wireless category.

Telecom Financial Data

Gross Revenue (GR) during the quarter

Rs. 98,250/- crore

% change in GR over the previous quarter

1.93%

Applicable Gross Revenue (ApGR) during quarter

Rs. 92,618/- crore

% change in ApGR over the previous quarter

0.30%

Adjusted Gross Revenue (AGR) during the quarter

Rs.79,226/- crore

% change in AGR over the previous quarter

1.66%

Share of Public sector undertakings in Access AGR

3.59%

Internet/Broadband Subscribers

Total Internet Subscribers

969.10 Million

% change over previous quarter

-0.11%

Narrowband subscribers

24.98 Million

Broadband subscribers

944.12 Million

Wired Internet Subscribers

41.41 Million

Wireless Internet Subscribers

927.70 Million

Urban Internet Subscribers

561.42 Million

Rural Internet Subscribers

407.69 Million

M

Total Internet Subscribers per 100 population

68.63

Urban Internet Subscribers per 100 population

110.79

Rural Internet Subscribers per 100 population

45.03

Total Outgoing Minutes of Usage for Internet Telephony

70.90 Million

No. of Public Wi-Fi Hotspots

55,052

Aggregate Data Consumed (TB) for Wi-Fi Hotspots

14,329

Broadcasting & Cable Services

Number of private satellite TV channels permitted by the Ministry of I&B for uplinking only/downlinking only/both uplinking and downlinking

918

Number of Pay TV Channels as reported by broadcasters

333

Number of private FM Radio Stations (excluding All India Radio)

388

Number of total active subscribers with pay DTH operators

56.92 Million

Number of Operational Community Radio Stations

531

Number of pay DTH Operators

4

Revenue & Usage Parameters

Monthly ARPU of Wireless Service

Rs.182.95

Minutes of Usage (MOU) per subscriber per month – Wireless Service

1026

Wireless Data Usage

Average Wireless Data Usage per wireless data subscriber per month

22.19 GB

Average revenue realization per GB for wireless data usage during the quarter

Rs.9.11

- Total number of Internet subscribers decreased from 970.16 million at the end of Dec-24 to 969.10 million at the end of Mar-25, registering a quarterly rate of decline 0.11%. Out of 969.10 million internet subscribers, number of Wired Internet subscribers are 41.41 million and number of Wireless Internet subscribers are 927.70 million.