INDIAN ECONOMY DEMONSTRATES RESILIENCE AND MAINTAINS HEALTHY MACROECONOMIC FUNDAMENTALS, DESPITE UNCERTAINTY FROM ADVERSE GEOPOLITICAL DEVELOPMENTS

Ministry of Finance

INDIA’S REAL GDP PROJECTED TO GROW AT 7.3 PER CENT IN FY 2023-24

INDIA CONTINUES ON PATH OF FISCAL CONSOLIDATION, TO REDUCE FISCAL DEFICIT BELOW 4.5 PER CENT BY 2025-26

11.1 PER CENT INCREASE IN CAPITAL EXPENDITURE OUTLAY FOR THE NEXT YEAR TO Rs. 11,11,111 CRORE

Posted On:

01 FEB 2024 12:53PM by PIB Delhi

Despite uncertainty from adverse geopolitical developments and expansionary fiscal measures taken during the COVID-19 pandemic, the Indian economy has demonstrated resilience and maintained healthy macroeconomic fundamentals. As per the First Advance Estimates of National Income of FY 2023-24, India’s Real GDP is projected to grow at 7.3 per cent. This was stated in the Macro-Economic Framework Statement 2024-25.

Strong domestic demand for consumption and investment, along with Government’s continued emphasis on capital expenditure are seen as among the key driver of the GDP in H1 of FY2023-24. On the supply side, industry and services sectors were the primary growth drivers in H1 of FY2023-24. India has registered the highest growth among major advanced and emerging market economies during this period. As per the IMF, India is likely to become the third-largest economy in 2027 in USD at market exchange rate. It also estimates that India’s contribution to global growth will rise by 200 basis points in 5 years.

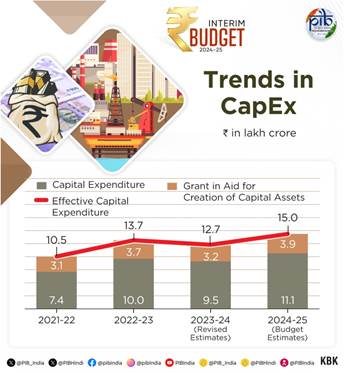

Noting that the massive tripling of the capital expenditure outlay in the past 4 years has resulted in huge multiplier impact on economic growth and employment creation, Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman announced an increase in capital expenditure outlay for the next year by 11.1 per cent to Rs. 11,11,111 crore. This would be 3.4 per cent of the GDP, she informed, while presenting the Interim Budget 2024-25 in the Parliament today. To further strengthen the growth momentum, the Government allocated Rs. 1.3 lakh crore in BE 2023-24 towards fifty-year interest-free loans to the States to boost their respective capital expenditures. The scheme will be continued this year, the Finance Minister added.

Calling the decade of 2014-23 as the golden era for FDI inflows, Smt. Sitharaman informed the House that the inflow during this period was twice the figure during 2005-14, amounting to USD 596 billion. “For encouraging sustained foreign investment, we are negotiating bilateral investment treaties with our foreign partners, in the spirit of ‘First Develop India’”, she added.

Macroeconomic stability and improvements in India’s external position, particularly significant moderation in the current account deficit and revival of capital flows on the back of a comfortable foreign exchange reserves buffer, resulted in stability in the Indian rupee during FY 2023-24. Further, inflationary pressures in India moderated majorly driven by proactive supply side initiatives by the Government, noted the Macro-Economic Framework Statement 2024-25.

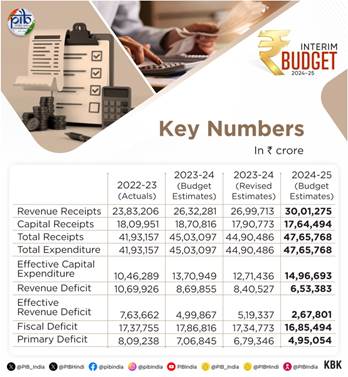

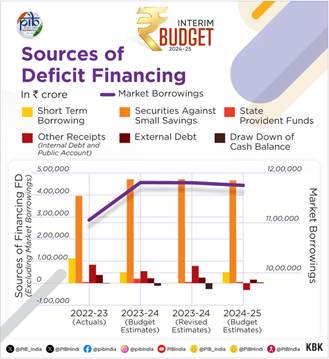

Delving on the Fiscal scenario of the Indian Economy, the Finance Minister said, “The fiscal deficit in 2024-25 is estimated to be 5.1 per cent of the GDP. We continue on the path of fiscal consolidation, as announced in my Budget Speech for 2021-22, to reduce fiscal deficit below 4.5 per cent by 2025-26”. In line with this commitment, RE 2023-24 projects Fiscal Deficit to GDP of 5.8 per cent, which is lower than the BE 2023-24 of 5.9 per cent, notes the Medium Term Fiscal Policy cum Fiscal Policy Strategy Statement.

Fiscal Indicators – Rolling Targets as a Percentage of GDP

|

|

Revised Estimates |

Budget Estimates |

|

2023-24 |

2024-25 |

|

|

1. Fiscal Deficit |

5.8 |

5.1 |

|

2. Revenue Deficit |

2.8 |

2.0 |

|

3. Primary Deficit |

2.3 |

1.5 |

|

4. Tax Revenue (Gross) |

11.6 |

11.7 |

|

5. Non-tax Revenue |

1.3 |

1.2 |

|

6. Central Government Debt |

57.8 |

56.8 |

(Source: Medium Term Fiscal Policy cum Fiscal Policy Strategy Statement)

Strategic priorities for FY 2024-25:

The Government’s fiscal policy stance has been to make the domestic economy more resilient to exogenous shocks and to mitigate the risks of global economic downturn without compromising on the overall macroeconomic balances. The FY 2024-25 fiscal strategy of the government is based on the following broad intents:

- Directing towards more inclusive, sustainable and more resilient domestic economy to absorb the unanticipated shocks, if any;

- Channelizing and allocating increased resources towards capital spending to sustain infrastructure development momentum;

- Continuing the holistic approach of fiscal federalism towards enhancing the public infrastructure by supporting efforts of the States for capital spending;

- Focus on integrated and coordinated planning and implementation of infrastructure projects in the country, embracing the principles of PM Gati Shakti;

- Prioritization of expenditure towards the key developmental sectors viz., drinking water, housing, sanitation, green energy, health, education, agriculture, rural development etc. for long run sustainable and inclusive betterment of the citizens;

- Enhancing the effectiveness of cash management through just-in-time release of resources by using SNA/TSA system etc.

*****

YKB/NB/VM