IIFCL announces Financial Results for FY 2024-25; Posts Fifth Consecutive Year of Record Performance with ₹51,124 Cr Sanctions and ₹28,501 Cr Disbursements

IIFCL announces Financial Results for FY 2024-25; Posts Fifth Consecutive Year of Record Performance with ₹51,124 Cr Sanctions and ₹28,501 Cr Disbursements

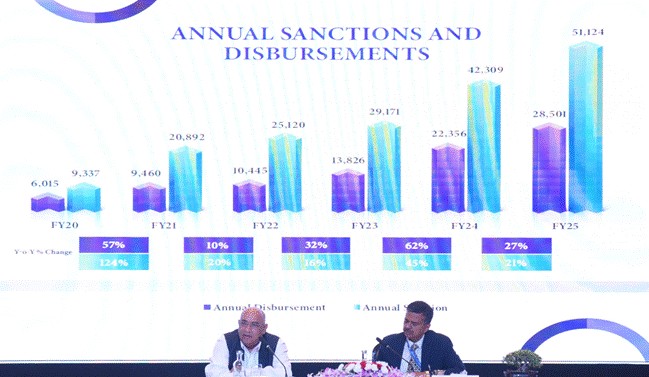

IIFCL recorded highest ever Annual Sanctions and Disbursements of Rs. 51,124 Crore and Rs. 28,501 Crore respectively, during the FY 2024-25, surpassing the previous years’ figures of Rs. 42,309 Crore and Rs. 22,356 Crore respectively, a y-o-y growth of ~21% and ~28% respectively.

The Cumulative Sanctions and Disbursements stood at Rs. 3.06 Lakh Crore and Rs. 1.56 Lakh Crore as of March 31, 2025, of which, ~55% of the Cumulative Sanctions and Disbursements were achieved in the last five years. The Consolidated Cumulative Sanctions and Disbursements of IIFCL stood at ~Rs. 3.53 Lakh Crore and ~Rs. 1.79 Lakh Crore as of March 31, 2025.

Dr. P.R. Jaishankar, Managing Director, India Infrastructure Finance Company Limited (IIFCL) announced all-time high performance of the company yesterday, for the fifth year in a row.

Highest ever Profitability Numbers

Enhanced Net worth

The company’s Net worth grew ~15% to Rs. 16,395 Crore in FY 2024-25 (up from Rs. 14,266 Crore in FY 2023-24 and ~59% over Rs. 10,306 Crore of FY 2019-20), thereby increasing capacity for IIFCL to lend more to infrastructure projects with higher exposure limits.

Growth with Quality

As of March 31, 2025, IIFCL was able to improve its asset quality with a significant decline in Gross NPA ratio to 1.11% (down from 1.61% in the previous year and 19.70% as on 31st March 2020) and Net NPA ratio to 0.35% (down from 0.46% in the previous year, which stood at 9.75% as on March 2020). The proportion of IIFCL’s assets externally rated ‘A’ and above increased to ~93% as of March 31, 2025 (up from ~88% as of March 2024 and ~43% in March 2020), indicating continuous improvement in the quality of company’s assets. IIFCL’s Capital to Risk-weighted Assets (CRAR) comfortably stood at 23.44%, much above the regulatory norms, as on 31st March 2025.

Loan Portfolio Growth

The company recorded y-o-y growth of ~37% in its Standalone Portfolio to Rs. 69,904 Crore in FY 2024-25 from Rs. 51,017 Crore in FY 2023-24.

IIFCL’s Growing Investment in Bonds and InvITs

In order to boost the availability of longer-tenor debt finance for infrastructure projects, IIFCL ventured into investment in Infrastructure Bonds and InvITs in FY 2021-22. Since then, the company has recorded a substantial increase in the investments in Bonds and InvITs with Rs. 29,102 Crore and Rs. 14,220 Crore respectively, till March 31, 2025.

Figures in Rs. Crore

Particulars

FY20

FY21

FY22

FY23

FY24

FY25

Annual Sanctions

9,337

20,892

25,120

29,171

42,309

51,124

Annual Disbursements

6,015

9,460

10,445

13,826

22,356

28,501

Profit Before Tax (PBT)

-291

315

590

1,277

2,029

2,776

Profit After Tax (PAT)

51

285

514

1,076

1,552

2,165

Gross NPA Ratio

19.70%

13.90%

9.22%

4.76%

1.61%

1.11%

Net NPA Ratio

9.75%

5.39%

3.65%

1.41%

0.46%

0.35%

Total Assets

52,147

55,525

56,964

59,485

65,493

81,572

Net Worth

10,306

10,654

11,737

12,878

14,266

16,395

Asset Quality (A and above)

43%

54%

64%

72%

88%

93%

Provision Coverage Ratio

50.51%

61.24%

62.75%

70.48%

71.53%

68.71%

Outstanding Loans

33,627

36,689

39,352

42,271

51,017

69,904

About IIFCL

IIFCL is a government-owned financial institution that caters to the long-term financing needs of India’s infrastructure sector. It is amongst the most diversified public sector infrastructure lenders in terms of eligible infrastructure sub-sectors and product offerings. IIFCL is also active in providing policy inputs in infrastructure financing space to the Government through various forums, with an aim to promote and develop world-class infrastructure in India.