HIGHLIGHTS OF THE UNION BUDGET 2024-25

HIGHLIGHTS OF THE UNION BUDGET 2024-25

The Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman presented the Union Budget 2024-25 in Parliament today. The highlights of the budget are as follows:

Part-A

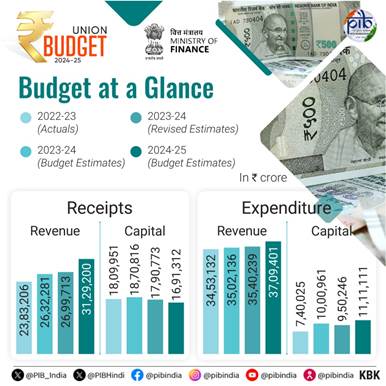

Budget Estimates 2024-25:

Package of PM’s five schemes for Employment and Skilling

Nine Budget Priorities in pursuit of ‘Viksit Bharat’:

Priority 1: Productivity and resilience in Agriculture

Priority 2: Employment & Skilling

Skill Development

Priority 3: Inclusive Human Resource Development and Social Justice

Purvodaya

Andhra Pradesh Reorganization Act

Women-led development

Pradhan Mantri Janjatiya Unnat Gram Abhiyan

Bank branches in North-Eastern Region

Priority 4: Manufacturing & Services

Credit Guarantee Scheme for MSMEs in the Manufacturing Sector

Credit Support to MSMEs during Stress Period

Mudra Loans

Enhanced scope for mandatory onboarding in TReDS

MSME Units for Food Irradiation, Quality & Safety Testing

E-Commerce Export Hubs

Critical Mineral Mission

Offshore mining of minerals

Digital Public Infrastructure (DPI) Applications

Priority 5: Urban Development

Transit Oriented Development

Urban Housing

Street Markets

Priority 6: Energy Security

Energy Transition

Pumped Storage Policy

Research and development of small and modular nuclear reactors

Advanced Ultra Super Critical Thermal Power Plants

Roadmap for ‘hard to abate’ industries

Priority 7: Infrastructure

Infrastructure investment by Central Government

Infrastructure investment by state governments

Pradhan Mantri Gram SadakYojana (PMGSY)

Irrigation and Flood Mitigation

Tourism

Priority 8: Innovation, Research & Development

Space Economy

Priority 9: Next Generation Reforms

Rural Land Related Actions

Urban Land Related Actions

Services to Labour

NPS Vatsalya

PART B

Indirect Taxes

GST

Sector specific customs duty proposals

Medicines and Medical Equipment

Mobile Phone and Related Parts

Precious Metals

Other Metals

Electronics

Chemicals and Petrochemicals

Plastics

Telecommunication Equipment

Trade facilitation

Critical Minerals

Solar Energy

Marine products

Leather and Textile

Direct Taxes

Simplification for Charities and of TDS

Simplification of Reassessment

Simplification and Rationalisation of Capital Gains

Tax Payer Services

Litigation and Appeals

Employment and Investment

Deepening tax base

Social Security Benefits.

Other major proposal in Finance Bill

Changes in Personal Income Tax under new tax regime

0-3 lakh rupees

Nil

3-7 lakh rupees

5 per cent

7-10 lakh rupees

10 per cent

10-12 lakh rupees

15 per cent

12-15 lakh rupees

20 per cent

Above 15 lakh rupees

30 per cent

- Scheme A – First Timers: One-month salary of up to `15,000 to be provided in 3 installments to first-time employees, as registered in the EPFO.

- Scheme B – Job Creation in manufacturing: Incentive to be provided at specified scale directly, both employee and employer, with respect to their EPFO contribution in the first 4 years of employment.

- Scheme C – Support to employers: Government to reimburse up to `3,000 per month for 2 years towards EPFO contribution of employers, for each additional employee.

- New centrally sponsored scheme for Skilling

- 20 lakh youth to be skilled over a 5-year period.

- 1,000 Industrial Training Institutes to be upgraded in hub and spoke arrangements.

- New Scheme for Internship in 500 Top Companies to 1 crore youth in 5 years