GST revenue collection for April 2024 highest ever at Rs 2.10 lakh crore

GST revenue collection for April 2024 highest ever at Rs 2.10 lakh crore

The Gross Goods and Services Tax (GST) collections hit a record high in April 2024 at ₹2.10 lakh crore. This represents a significant 12.4% year-on-year growth, driven by a strong increase in domestic transactions (up 13.4%) and imports (up 8.3%). After accounting for refunds, the net GST revenue for April 2024 stands at ₹1.92 lakh crore, reflecting an impressive 15.5% growth compared to the same period last year.

Positive Performance Across Components:

Breakdown of April 2024 Collections:

Inter-Governmental Settlement: In the month of April, 2024, the central government settled ₹50,307 crore to CGST and ₹41,600 crore to SGST from the IGST collected. This translates to a total revenue of ₹94,153 crore for CGST and ₹95,138 crore for SGST for April, 2024 after regular settlement.

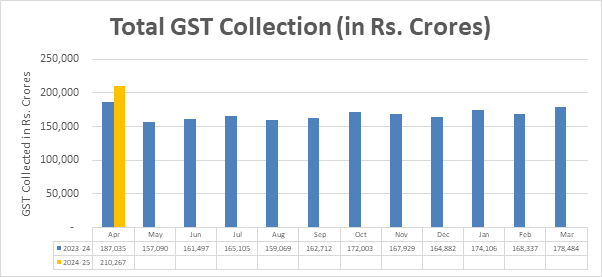

The chart below shows trends in monthly gross GST revenues during the current year. Table-1 shows the state-wise figures of GST collected in each State during the month of April, 2024 as compared to April, 2023. Table-2 shows the state-wise figures of post settlement GST revenue of each State for the month of April, 2024.

Chart: Trends in GST Collection

Table 1: State-wise growth of GST Revenues during April, 2024[1]

State/UT

Apr-23

Apr-24

Growth (%)

Jammu and Kashmir

803

789

-2%

Himachal Pradesh

957

1,015

6%

Punjab

2,316

2,796

21%

Chandigarh

255

313

23%

Uttarakhand

2,148

2,239

4%

Haryana

10,035

12,168

21%

Delhi

6,320

7,772

23%

Rajasthan

4,785

5,558

16%

Uttar Pradesh

10,320

12,290

19%

Bihar

1,625

1,992

23%

Sikkim

426

403

-5%

Arunachal Pradesh

238

200

-16%

Nagaland

88

86

-3%

Manipur

91

104

15%

Mizoram

71

108

52%

Tripura

133

161

20%

Meghalaya

239

234

-2%

Assam

1,513

1,895

25%

West Bengal

6,447

7,293

13%

Jharkhand

3,701

3,829

3%

Odisha

5,036

5,902

17%

Chhattisgarh

3,508

4,001

14%

Madhya Pradesh

4,267

4,728

11%

Gujarat

11,721

13,301

13%

Dadra and Nagar Haveli and Daman & Diu

399

447

12%

Maharashtra

33,196

37,671

13%

Karnataka

14,593

15,978

9%

Goa

620

765

23%

Lakshadweep

3

1

-57%

Kerala

3,010

3,272

9%

Tamil Nadu

11,559

12,210

6%

Puducherry

218

247

13%

Andaman and Nicobar Islands

92

65

-30%

Telangana

5,622

6,236

11%

Andhra Pradesh

4,329

4,850

12%

Ladakh

68

70

3%

Other Territory

220

225

2%

Center Jurisdiction

187

221

18%

Grand Total

1,51,162

1,71,433

13%

Table-2: SGST & SGST portion of IGST settled to States/UTs

April (Rs. in crore)

Pre-Settlement SGST

Post-Settlement SGST[2]

State/UT

Apr-23

Apr-24

Growth

Apr-23

Apr-24

Growth

Jammu and Kashmir

394

362

-8%

918

953

4%

Himachal Pradesh

301

303

1%

622

666

7%

Punjab

860

999

16%

2,090

2,216

6%

Chandigarh

63

75

20%

214

227

6%

Uttarakhand

554

636

15%

856

917

7%

Haryana

1,871

2,172

16%

3,442

3,865

12%

Delhi

1,638

2,027

24%

3,313

4,093

24%

Rajasthan

1,741

1,889

9%

3,896

3,967

2%

Uttar Pradesh

3,476

4,121

19%

7,616

8,494

12%

Bihar

796

951

19%

2,345

2,688

15%

Sikkim

110

69

-37%

170

149

-12%

Arunachal Pradesh

122

101

-17%

252

234

-7%

Nagaland

36

41

14%

107

111

4%

Manipur

50

53

6%

164

133

-19%

Mizoram

41

59

46%

108

132

22%

Tripura

70

80

14%

164

198

21%

Meghalaya

69

76

9%

162

190

17%

Assam

608

735

21%

1,421

1,570

10%

West Bengal

2,416

2,640

9%

3,987

4,434

11%

Jharkhand

952

934

-2%

1,202

1,386

15%

Odisha

1,660

2,082

25%

2,359

2,996

27%

Chhattisgarh

880

929

6%

1,372

1,491

9%

Madhya Pradesh

1,287

1,520

18%

2,865

3,713

30%

Gujarat

4,065

4,538

12%

6,499

7,077

9%

Dadra and Nagar Haveli and Daman and Diu

62

75

22%

122

102

-16%

Maharashtra

10,392

11,729

13%

15,298

16,959

11%

Karnataka

4,298

4,715

10%

7,391

8,077

9%

Goa

237

283

19%

401

445

11%

Lakshadweep

1

0

-79%

18

5

-73%

Kerala

1,366

1,456

7%

2,986

3,050

2%

Tamil Nadu

3,682

4,066

10%

5,878

6,660

13%

Puducherry

42

54

28%

108

129

19%

Andaman and Nicobar Islands

46

32

-32%

78

88

13%

Telangana

1,823

2,063

13%

3,714

4,036

9%

Andhra Pradesh

1,348

1,621

20%

3,093

3,552

15%

Ladakh

34

36

7%

55

61

12%

Other Territory

22

16

-26%

86

77

-10%

Grand Total

47,412

53,538

13%

85,371

95,138

11%

[1]Does not include GST on import of goods

[2] Post-Settlement GST is cumulative of the GST revenues of the States/UTs and the SGST portion of the IGST settled to the States/UTs