DLI Scheme-backed Chip Design Startup — Vervesemi Microelectronics Raises $10 Million In A Series A Funding Round

DLI Scheme-backed Chip Design Startup — Vervesemi Microelectronics Raises $10 Million In A Series A Funding Round

Semiconductor chip design is a critical value driver across the semiconductor value chain, defining system architecture, performance, functionality and security, while contributing up to half of the overall value addition and accounting for 15–35% of the bill of materials (BOM) cost of electronic products.

Recognising the pivotal role of design in the country’s strategic technological ambitions, the Design Linked Incentive (DLI) Scheme, under the Semicon India Programme, has approved 24 semiconductor design projects from domestic startups and MSMEs for financial support. These companies are developing chips for a range of strategic and commercial applications, including satellite communications, drones, surveillance cameras, Internet of Things (IoT) devices, LED drivers, AI systems, telecom equipment and smart meters.

More than 400 organisations (including over 100 startups and 300 academic institutions) have been granted access to advanced chip design tools hosted centrally at C-DAC Bengaluru, cumulatively utilising 2.25 crore hours of tool usage, making this one of the largest user bases globally.

Vervesemi Microelectronics

Among these, Vervesemi Microelectronics, the first company approved under the Government of India’s DLI Scheme and also supported under the Chips to Startup (C2S) programme, was founded in 2017 by industry veterans with experience at global semiconductor company.

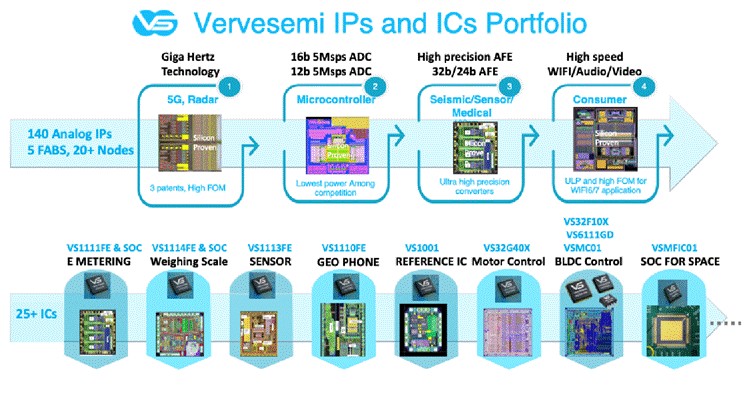

The company holds a portfolio of over 140 IPs, 25 IC products, 10 patents and 5 trade secrets, and is developing chips for space, defence, industrial and smart energy applications. Details at https://vervesemi.com/

Some of the key chips designed by Vervesemi are:

#

Chip

Foundry

Application

Status

Targeted production schedule

1

Data Acquisition avionic chip

(Multi-function)

55nm, UMC

Identified Space customer

Fabricated and undergoing customer evaluation

2027-Q1

2

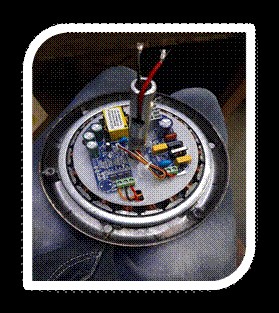

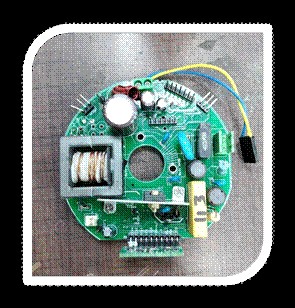

BLDC Controller chipset

90% indigenous BOM with Chip-1 (Using indigenous RISC-V Microprocessor) and Chip-2 (Quad Gate Driver chip with DC-DC) and Chip-3 (Power MOSFET)

110nm, UMC

Fan, Exhaust, Solar, Power Inverter

Controller chip in Fabrication.

Gate Driver-MOSFET chip Fabricated and undergoing customer evaluation

2026 -Q4

3

Precision Motor-Control chip using RISC-V Microprocessor

55nm, UMC

Drones, EV and industrial automation

Fabricated and undergoing testing

2026 -Q3

4

Energy metering chip

180nm, TSMC

Energy meter

Fabricated and tested

2026 -Q4

5

Bridge Applications chip

180nm, TSMC

Weighing scale and Force Touch application

Fabricated and tested

2026 -Q3

Investor Confidence — Supporting India’s Deep-Tech Innovation to Scale Global Solutions

Vervesemi announced today the raising of $10M (about ₹90 Crore) in a Series A funding round led by investor Ashish Kacholia and Unicorn India Ventures, with participation from Roots Ventures, Caperize Fina and MAIQ Growth Scheme.

The funds will be utilised across three strategic areas. First, the company will accelerate commercialisation of its machine learning-enhanced analog signal chain chip portfolio, including advanced data converters and intelligent power and sensing solutions for industrial, smart energy, motor control and avionics applications.

Second, the investment will support production readiness and qualification of existing silicon, along with expansion of engineering and applications teams to serve global customers.

Third, the company will expand its IP portfolio and strengthen R&D in next-generation precision analog architectures, while building market presence across Asia, the United States and other key semiconductor markets to engage with original equipment manufacturers and system companies.

The investment in Vervesemi reiterates that structured support under the DLI Scheme has strengthened investor confidence and improved commercial viability, leading investors to actively evaluate and commit capital to DLI-approved companies.

From Announcement to Realisation: India’s Design-Led Semiconductor Vision Takes Shape

The project of BLDC (Brushless Direct Current) motor controller targeted for Fan, Exhaust etc was awarded to Vervesemi by the Minister Shri Ashwini Vaishnaw on 20th March 2025.

During the award ceremony, the Minister stated that the country must collectively adopt three approaches to become a product nation. First, while India has achieved significant success as a service nation, it must now evolve into a product nation, and the development of indigenous software and hardware solutions marks an important step in that direction. Second, innovation should emerge from a broad ecosystem involving academia, startups, students and researchers. Third, the development approach should be incremental and span the full technology spectrum, from high-volume deployment chips such as BLDC motor controllers to high-value strategic platforms like the open-source RISC-V architecture, enabling domestic design of CPUs, GPUs and sustainable technology products for the country.

Conclusion

In less than a year since the announcement by the Minister, the progress achieved by Vervesemi, both in attracting investment and in user adoption, demonstrates that DLI-supported firms are delivering multiple chip tape-outs, silicon-proven designs, patents, reusable IPs, trained talent and operational design infrastructure, creating tangible on-ground impact.

As the ecosystem enters the productization phase, silicon-validated designs will move toward volume manufacturing and deployment, positioning Indian companies as credible global suppliers while strengthening domestic supply chains and self-reliance.

The DLI Scheme anchors India in the strategic chip design segment by reducing dependence on imports, enhancing resilience to supply-chain disruptions, and ensuring access to critical technologies for defence, telecom, AI and mobility, thereby supporting long-term economic growth.

****