Banking Laws (Amendment) Act, 2025

Banking Laws (Amendment) Act, 2025

Key Takeaways

Introduction

A nation’s economic success depends largely on its financial system. Typically, banking institutions provide a variety of services, such as taking deposits, making loans, assisting with transactions, and providing different financial goods including credit cards, savings accounts, and loans to the public. India’s banking system facilitates investment and individual financial needs and therefore, plays a crucial role in the country’s economic development.

India’s banking sector has indeed undergone a remarkable transformation, evolving from a paper-based, branch-centric system to a leading digital landscape driven by key technological and policy milestones. It has transformed from traditional banking and initial computerisation to biometric identity system – Aadhaar and brought millions of unbanked people into the formal financial system through Pradhan Mantri Jan Dhan Yojana. Such initiatives of the government have been instrumental in promoting financial inclusion by bridging the gap between urban and rural populations and bringing formal banking services to millions.

The Banking Laws (Amendment) Act, 2025 is a step towards strengthening governance standards in the banking sector by ensuring uniformity in reporting by banks to the Reserve Bank of India along with improved audit quality in public sector banks (PSBs). The act enhances depositor and investor protection by promoting customer convenience through improved nomination facilities.

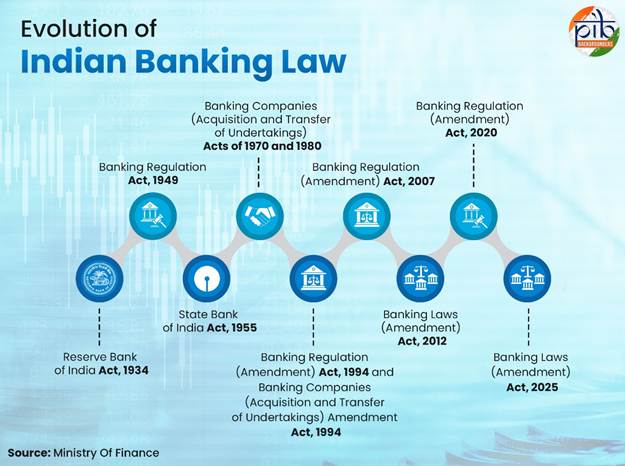

Evolution of India’s Banking Laws

India’s banking regulation has evolved alongside the country’s economic and institutional development, guided by five cornerstone legislations that continue to define its financial architecture.

The Reserve Bank of India is the central bank of the country. The Reserve Bank of India Act, 1934 (II of 1934) establishes the legal foundation for the Bank’s operations. It was constituted to primarily regulate the issue of banknotes, maintain reserves in order to secure monetary stability and operate the credit and currency system of the country. In order to strengthen the nation’s financial infrastructure, the bank also played a key role in the establishment of organizations such as the Unit Trust of India, the Industrial Development Bank of India, the National Bank of Agriculture and Rural Development and others.

The Banking Regulation Act, 1949 followed soon after independence, consolidating control over banking activities under a uniform legal structure. It is one of the most significant legislative frameworks in India, regulating the banking sector to ensure stability, security, and growth.

The State Bank of India Act, 1955 marked the formal establishment of the State Bank of India (SBI), transforming the undertaking of the Imperial Bank of India, with a mandate to expand banking facilities on a large scale, more particularly in the rural and semi-urban areas, and for diverse other public purposes.

In order to better serve the needs of development of the economy in conformity with the national policy objectives, 14 significant Indian Scheduled Commercial Banks with deposits over Rs 50 crores were nationalized in 1969. Further, a fresh Ordinance was issued which was later replaced by the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970. To promote the welfare of the people, The Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980 was passed to provide for the acquisition and transfer of the undertakings of certain banking companies.

In addition to these, several important amendments to the RBI Act such as the Banking Regulation (Amendment) Act, 1994, the Banking Companies (Acquisition and Transfer of Undertakings) Amendment Act, 1994 and the Banking Regulation (Amendment) Act, 2007, the Banking Laws (Amendment) Act, 2012 relating to governance, capital flexibility, Statutory Liquidity Ratio (SLR) or Cash Reserve Ratio (CRR) based liquidity management were introduced, reforming India’s banking framework.

With The Banking Regulation (Amendment) Act, 2020, additional powers were provided to the Reserve Bank of India for enhanced effective regulation of Co-operative banks. Continuing this momentum, in a recent reform, The Banking Laws (Amendment) Act, 2025 amends five acts viz. the Reserve Bank of India Act, 1934, the Banking Regulation Act, 1949, the State Bank of India Act, 1955, the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 and the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980. The move aims to enhance banking governance, improve audit transparency, strengthen depositor protection, and bring cooperative banks under a more robust regulatory framework.

Addressing Emerging Challenges: Need of the Banking Amendment Act, 2025

💡Fact Focus: Why Nomination Matters?

Huge amount lies across banks, as unclaimed deposits, often because no nominee was recorded. The new rules are targeted to cut this delay by ensuring smoother claim settlements and faster access for families.

Household reliance on the banking system has intensified in the recent times with the Government aiming to extend financial services to the large hitherto un-served population of the country to unlock its growth potential. In order to keep pace with the rising complexity as financial inclusion deepens and access to banking expands nationwide, it becomes essential to reduce manual work, match operations with industry scale and technology and shift statutory deadlines for better compliance.

The Banking Amendment Act, 2025 has been introduced amid rapid digital growth and evolving financial challenges. The reform seeks to align governance and compliance frameworks with contemporary industry dynamics and evolving technology. The provisions are primarily needed to:

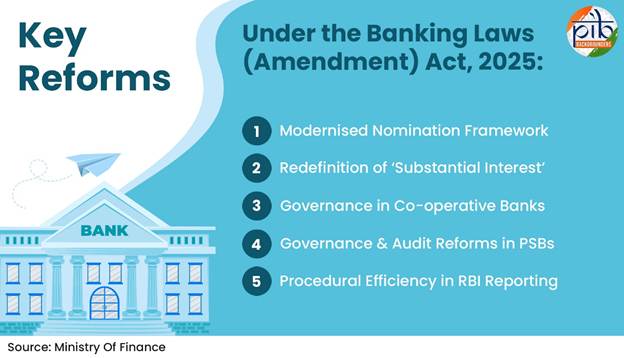

Banking Laws (Amendment) Act, 2025: Key Reforms

The Banking Laws (Amendment) Act, 2025 introduces key reforms focused on depositor security, governance strength, and faster resolution of stress. Beyond structural updates, the 2025 Act reinforces India’s ongoing efforts to enhance banking oversight and governance. The changes are rooted in practical challenges visible over the last decade. The provisions of the act were notified in two stages: Section 3 to 5 and 15-20 were covered in Stage 1 (1st August, 2025) while Sections 10 to 13 were covered in Stage 2 (1st November 2025).

The key reforms are described in detail below, outlining the major improvements that have been implemented to improve current systems and processes.

Modernised Nomination Framework (Sections 10 – 13)

Redefinition of ‘Substantial Interest’ (Section 3)

Governance in Co-operative Banks (Section 4 & 14)

Audit Reforms in PSBs (Sections 15-20)

Procedural Efficiency of the System

In particular, reporting requirements that earlier referred to “last Friday” or “alternate Fridays” have now been aligned to the last day of the month or the last day of the fortnight, as applicable.

Impact of the Banking Reforms with National Vision

A major step in fortifying the legal, regulatory, and governance structure of the Indian banking sector has been taken with the implementation of these laws. The 2025 amendments shall have a transformative impact on depositors and service providers.

Conclusion

The Banking Laws (Amendment) Act, 2025 represents a significant stride towards modernizing India’s financial architecture. By aligning governance norms, depositor safeguards, and audit practices with current economic realities, the Act not only strengthens public confidence but also supports India’s vision of a secure, inclusive, and technology-driven banking system. These reforms reinforce stability, transparency, and efficiency essential pillars for sustaining growth in an increasingly digital economy.

References

Ministry of Finance:

https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=2181734

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2150371

https://financialservices.gov.in/beta/en/banking-overview

https://financialservices.gov.in/beta/sites/default/files/2025-05/Gazettee-Notification_1.pdf

https://www.pib.gov.in/PressReleseDetailm.aspx?PRID=2117408

https://www.pib.gov.in/PressReleasePage.aspx?PRID=1868239

Reserve Bank of India:

https://rbi.org.in/scripts/briefhistory.aspx

https://rbi.org.in/history/Brief_Chro1968to1985.html

https://rbi.org.in/commonman/english/scripts/Notification.aspx?Id=1476

Others:

https://www.indiacode.nic.in/bitstream/123456789/1885/1/A194910.pdf

https://www.indiacode.nic.in/handle/123456789/1553?view_type=browse

Rajya Sabha:

https://sansad.in/getFile/annex/268/AU1038_fL1aXP.pdf?source=pqars