Code on Wages, 2019 Safeguards Workers, Induces Growth, Empowers Women & Enhances Employment

Code on Wages, 2019 Safeguards Workers, Induces Growth, Empowers Women & Enhances Employment

Introduction

The Government of India remains committed to promoting equality and social justice through inclusive policies and programmes that uplift all sections of the society. The Ministry of Labour and Employment aims to enhance employment opportunities in a sustainable manner by providing decent working conditions and quality of life.

The second National Commission on Labour had recommended that the existing Labour Laws should be broadly grouped into four or five Labour Codes on functional basis. Consequently, the Code on Wages, 2019 is one of the four codes of the labour laws that has been enacted. The Code on Wages, 2019 is a step to advance equity and labour welfare while ensuring enterprise sustainability. It standardizes definitions of key terms and streamlines procedures, reducing ambiguity and ensuring faster, time bound justice for employers. The bigger aim of the labour reforms is to drive economic growth through generation of decent employment opportunities for all.

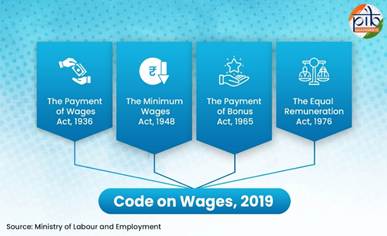

The Code on Wages, 2019: Laws Subsumed

The Code on Wages, 2019, amalgamates 4 wages and payment related labour laws viz. The Payment of Wages Act, 1936, The Minimum Wages Act, 1948, The Payment of Bonus Act, 1965 and The Equal Remuneration Act, 1976. It strikes a balance between protecting the rights of workers and facilitating ease of compliance for employers. The Code introduces key reforms to streamline and strengthen labour regulation.

The Code safeguards employee interests through fair wages, social security, and protection against exploitation, ensuring dignity and stability at work. It supports women workers through equal pay and representation, fostering inclusive participation. By ensuring fair wages and social security for all workers, it drives productivity and labour welfare. Together, these measures strengthen economic growth, employment generation, and workplace equity.

DID YOU KNOW?

The Labour Reforms simplify the registration and licensing framework by introducing the concept of a Single Registration, Single License, and Single Return, thereby reducing the overall compliance burden to improve employment.

The Code on Wages, 2019 has reduced the number of rules from 163 to 58, number of forms from 20 to 6 and number of registers from 24 to 2.

Ensuring Fair and Minimum Wages

Impact

The code safeguards interests of the vulnerable groups, improves living standards, reduces poverty, and promotes formal employment.

Universalisation of Minimum wages

Section 5 of the Code on Wages, 2019 establishes a statutory right to minimum wages for all employees, extending its coverage to every sector, both organised and unorganised. Earlier, the minimum wages applied only to scheduled employments, covering roughly 30% of the workforce.

Pro Worker Provisions

Pro Employment Provisions

Impact

The provision reduces regional wage disparities, provides social justice, prevents wage undercutting by states, and promotes equity across the country.

Introduction of floor wages

Section 9 read with Rule 11 of the Code introduces floor wages as a statutory provision. The baseline wages will be fixed by the Central government on the basis of minimum living standards of an employee including food, clothing etc. It will be revised at regular intervals. State governments must ensure their minimum wages are not lower than this floor level.

Pro Worker Provisions

Pro Growth Provisions

Fixing Minimum wages

Impact

Such fixation of wages recognizes skills and arduousness, motivates employee to upskill, ensures fair compensation, and improves job satisfaction.

Minimum wage rates for timework, piece work for different wage period i.e. by hours, day or by month to be fixed by the appropriate Government. It will be based on the skill of employee, and/or geographical area and arduousness of work. The minimum rate of wages may consist of basis rate of wages and allowances. The government shall revise minimum rate of wages ordinarily at an interval not exceeding five years.

Pro Worker Provisions

Re-defining the wage components

Impact

Even contractual and informal workers will enjoy the same fair wage structure and social security base. Improved inclusiveness and reduced exploitation as contractual and informal workers enjoy same fair wage structure and social security base.

For the purpose of calculation of benefits and social security contributions, the redefined wage includes basic pay, dearness allowance and retaining allowance. In case allowances and contributions exceed over 50% (as may be notified by the Central Government) of the total payment, excess amount shall be added to the wage. The social security contributions and benefits (like PF, gratuity, maternity benefits and bonus) will be based on a larger and fairer portion of pay, resulting in higher future benefits.

Stating working hours

Impact

The rule safeguards employee health, prevents over-exploitation, promotes work-life balance, and improves productivity.

Section 13 read with Rule 6 of the Code limits normal working hours to prevent employees from being overworked without adequate compensation. The period of work shall not exceed 48 hours a week, if employee is working for less than 6 days a week. The period of work shall not exceed 12 hours in a day in cases where flexibility is provided. This includes intervals for rest. The remaining days of that week shall be a paid holiday for the employee.

Securing Fair and Consistent Wage Payments

Ensuring payment of wages

Under Section 43 of the Code, every employer shall pay wages to the employee employed by him. In cases of failure, the company or firm or association or any other person who is the proprietor of the establishment, in which the employee is employed, shall be responsible for such unpaid wages, reinforcing employer liability under the Code.

Timely payment of wages

The provisions relating to timely payment of wages and un-authorized deductions from wages, which were earlier applicable only in respect of employees drawing wages upto to ₹24,000 per month, is now applicable to all employees irrespective of the wage ceiling. It protects both blue-collar and white-collar employee, bringing them under a uniform wage protection framework. The provision ensures fairness in wages as every employer, regardless of salary and designation, is covered equally under the law.

Timely Limit for payment of wages

In accordance with Section 17 of the Code on Wages, 2019, the employer shall pay or cause to be paid wages to all the employees, engaged on

This guarantees timely income, prevents financial distress, and ensures employee can meet essential needs.

Proof of Payment and Employment

Under Section 50(3) read with Rule 34 of the Code on Wages, 2019 the employers shall provide wage slips, electronically or in physical form, on or before wage payment, ensuring transparency and reducing disputes. This provides a documentary proof of employment and compensation. It also extends as a protection to employees in both organised and unorganised sectors including daily wagers and contracts employees.

Payment of Annual Bonus

Payment of bonus is applicable to every employee, drawing wages not exceeding such amount as fixed by appropriate government, who has worked for at least 30 days in an accounting year. The annual bonus is paid minimum at the rate of eight and one-third % and maximum up to 20% of the wages earned by the employee. This promotes economic justice by profit sharing, boosts employee morale, loyalty and motivation.

Extension of Limitation Period

The Code on Wages, 2019 provides that period of limitation for filing of claims by an employee from the earlier duration of 6 months-2 years has been enhanced to a period of 3 years. This gives employees more time to gather evidence, seek support, and pursue justice effectively.

Minimum Time Rate Wages for Piece Work

Under Section 12 of the Code of Wages, 2019, if an employee is employed on piece work where a minimum time rate (instead of a piece rate) is fixed, the employer must pay wages not less than this minimum time rate.

Pro Worker Provisions

Payment of overtime

In accordance with Section 14 of Code on Wages, 2019 employers must pay overtime wages at a rate not less than twice the normal wages for any work performed beyond regular working hours.

Pro Worker Provisions

Ensuring Payment of Wages: Benefits the Employees

Decriminalization and Composition of Offences

Impact

First Time Offenders

The Code introduces a provision for compounding first-time offences that are not punishable by an imprisonment. However, no offence of same nature shall be compounded, if it has been repeated within a period of five years.

Composition of Offences

Section 56 read with Rule 36 of the code replaces criminal penalties (like imprisonment) with civil penalties (like graded monetary fines) for first time offences punishable with fine only. It introduces a provision of compounding for offenses punishable (with fine only) by paying sum of fifty percent of the maximum fine. For employers, it ensures that wage laws benefit the employees directly. For employees, it creates a work environment that is not driven by fear.

Growth Inducive Provisions of the Code

One Nation, One Code on Wage

Section 2 read with Rule 31 of the Code consolidates four existing wage laws into one with a uniform definition of wages, worker, employee etc.

Inspector-cum-Facilitators

In accordance with Section 51 of Code on Wages, 2019, the term Inspector is replaced with Inspector-cum-Facilitator emphasizing a dual role that combines enforcement with guidance. The facilitator will provide information, raise awareness, and offer advice to employers and employees to promote better compliance and worker welfare.

Protection of Employer’s Assets

Section 64 of the Code safeguards any amount deposited with the appropriate Government by an employer to secure the due performance of a contract with that Government and any other amount due to such employer from that Government in respect of such contract shall not be liable to attachment under any decree or order of any court in respect of any debt or liability incurred by the employer other than any debt or liability incurred by the employer towards any employee employed in connection with the contract aforesaid.

Gender Inclusive Employment Policies

Prohibition of Gender Discrimination

Pursuant to Section 3 of Code on Wages, 2019, there shall be no discrimination on the basis of gender, including transgender identity, in matters of recruitment, wages, or employment conditions for the same or similar work performed by employees. Unfair wage disparities based on gender shall be removed and equal pay for equal work will be ensured.

Women’s Representation on Advisory Boards

In order to ensure women’s voices in policy-making, leading to more inclusive and balanced employment policies, Section 42 of the Code provides that one-third members of the Central/State Advisory Boards shall be women. The boards shall advise on fixation or revision of minimum wages, providing increasing employment opportunities for women.

Conclusion

The Code on Wages, 2019 promotes fairness, equity, and inclusivity in India’s labour market. By ensuring uniform wage standards and social security, it safeguards both workers’ rights and employers’ interests. Overall, it strengthens economic justice, encourages formalisation, and enhances the dignity of labour.

References

Ministry of Law and Justice

https://labour.gov.in/sites/default/files/the_code_on_wages_2019_no._29_of_2019.pdf

Ministry of Labour & Employment

https://dtnbwed.cbwe.gov.in/images/upload/Code-on-Wages–_03L6.pdf