From Shacks to SHGs: GST Reforms to Boost Goa’s Economy

From Shacks to SHGs: GST Reforms to Boost Goa’s Economy

Key Takeaways

Introduction

Known for its susegad spirit, Goa’s economy thrives on a vibrant mix of tourism, traditional industries, and modern enterprises. Tourism alone accounts for nearly 16% of Goa’s GSDP, while pharmaceuticals, fisheries, cashew processing, and handicrafts sustain numerous livelihoods across its towns and villages.

The recent GST reforms come as a timely boost to this diverse economy, increasing affordability, reducing input costs, and enhancing competitiveness across sectors.

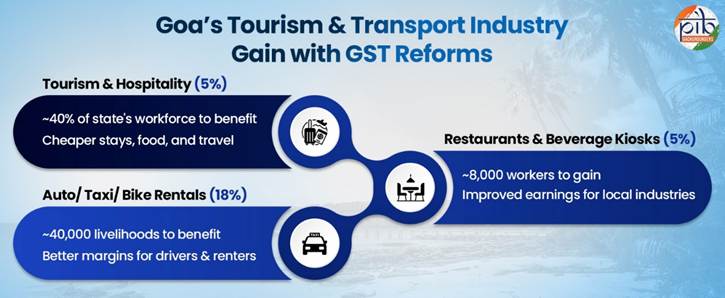

Tourism & Transport Industry

Tourism & Hospitality

The new GST rates are expected to boost Goa’s strong tourism & hospitality industry covering North Goa’s beach belt areas such as Calangute, Candolim, Baga, and Anjuna, along with Panaji and the South Goa regions of Colva, Benaulim, and Palolem.

As of March 2025, the sector employed around 2.5 lakh people, representing nearly 40% of Goa’s total workforce. Tourism contributes 16.43% to the state’s GSDP, making it a strong driver of the local economy.

With the GST rate cuts, input costs are expected to reduce significantly. Typical amenities such as toiletries, tableware, and breakfast staples, shifting from 18% to 5% are likely to see an approximate 11% reduction in their prices. Also, pre-packaged tender coconut water and similar items moving from 12% to 5% may become cheaper by about 6.25%. The reforms collectively lower operational costs and enhance affordability within Goa’s tourism value chain.

Restaurants & Beverage Kiosks

Restaurants and beverage kiosks in Goa, including beach shacks, cafés, and juice stalls, are set to benefit from the GST reduction from 12% to 5% on fruit juices. Employing around 8,000 people, the sector comprises shack vendors, fruit juice sellers, and small kiosk operators who depend heavily on daily tourist footfall.

The GST cut is expected to reduce costs by approximately 6.25%, enhancing affordability for consumers. This will also boost sales for small vendors, and improve earnings for local entrepreneurs.

Auto/taxi & bike-rental ecosystem

The auto, taxi, and bike-rental ecosystem in Goa is expected to benefit from the recent GST reforms, which reduced the tax rate on small cars (≤1200cc) and bikes (≤350cc) from 28% to 18%. The change directly impacts taxi unions and rental firms operating across airports, railway stations, and coastal belts. The sector sustains around 40,000 livelihoods, including taxi drivers, bike renters, and mechanics, largely self-employed and dependent on tourist demand.

During FY 2023-24, the auto, taxi, and rental transport segment contributed approximately 2% to Goa’s GSDP. With the GST rate cut, the on-road tax component is expected to fall by nearly 7.8% of the final vehicle price. Financing benefits further magnify this affordability, helping local operators, while improving transport accessibility for tourists & locals.

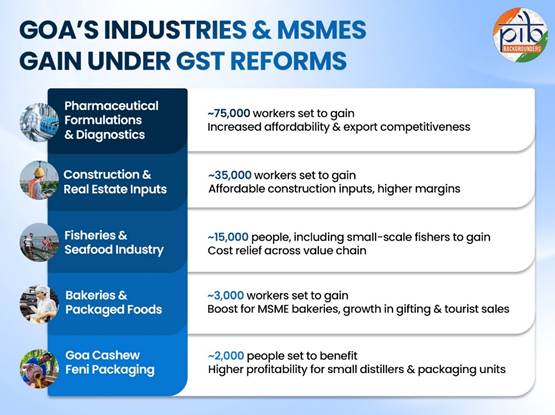

Pharmaceutical Formulations & Diagnostics

The pharmaceutical formulations and diagnostics sector is concentrated in the Verna, Pilerne, Kundaim, Corlim, Bicholim, and Ponda industrial estates, supported by logistics through the Mormugao port. It employs skilled chemists, lab technicians, shop-floor workers, and QC staff, with both migrant and local workforces depending on steady jobs in formulation and IVD units.

As of 2022, the industry employed over 75,000 people, representing 22.5% of the state’s total factory workforce. The sector caters to the Indian diagnostics market as well as export buyers across Asia and Africa. In 2023-24, drugs and pharmaceuticals made up 51% of Goa’s total merchandise exports.

With the revised GST rates, many inputs and services have been reduced from 18% to 5%, while certain medical items have moved to nil. These revisions are expected to bring prices down by around 11%, while nil-rated items such as books and stationery used by laboratories are expected to become cheaper by approximately 4.8%. These changes are expected to enhance affordability and competitiveness across Goa’s pharmaceutical ecosystem.

Construction & Real Estate Inputs

The construction and real estate sector in Goa has gained from the recent GST reforms, which reduced the tax rate on cement from 28% to 18%, along with cuts on several other materials. The reforms benefit real-estate and hotel projects across North and South Goa, as well as infrastructure and homestay developments. The sector employs around 35,000 people, including daily-wage masons, plumbers, electricians, and carpenters. Together, construction and real estate contributed about 13.4% to Goa’s GSDP in 2023-24.

Lower GST rates directly reduce input costs for developers and builders, improving margins and affordability for both residential and commercial projects. The rate reduction on cement alone, from 28% to 18%, is estimated to lower prices by about 7.8% at the same ex-factory rate, resulting in approximately ₹25-30 savings per bag.

Fisheries & Seafood Industry

The fisheries and seafood value chain in Goa, central to Khariwada (Vasco), Cutbona (Betul), Talpona, Malim, Chapora, and Cortalim, now benefits from a reduced GST rate of 5%. Contributing to around 2.5% to Goa’s GSDP, the industry sustains boat crews, small-scale fishers, migrant deckhands, auctioneers, and women vendors, with many coastal families relying on seasonal fishing for income. In 2016, around 15,000 people were employed in the sector.

The GST reforms have brought relief across the value chain, covering both input materials and seafood products. By lowering GST on nets, feed, and aquaculture inputs to 5%, production costs are expected to decline and improve profit margins. Items earlier taxed at 12% and 18% now attract only 5%, leading to an estimated reduction of about 6.25% and 11% respectively in consumer prices.

This directly supports frozen fish and shrimp exporters in Margao and Vasco, and helps bring export competitiveness in local and global markets including the US, EU, and Japan.

Bakeries & Packaged Foods

Goa’s bakery and packaged food sector, covering pastries, biscuits, namkeen, pasta, noodles, and chocolates, stands to gain significantly from the GST rate cut from 12%/ 18% to 5%. This reduction is expected to lower product prices by around 6.25-11%, boosting affordability for both locals and tourists.

The industry is largely made up of small sized bakeries spread across the state, with key markets in Mapusa and Margao. It sustains a diverse workforce of nearly 3,000 people, including bakery owners, pastry chefs, packers, and delivery staff.

The lower GST rate is expected to enhance competitiveness of MSME bakeries, encourage higher sales, and improve profit margins, especially for small enterprises catering to tourist gifting and exports.

Agriculture & Horticulture

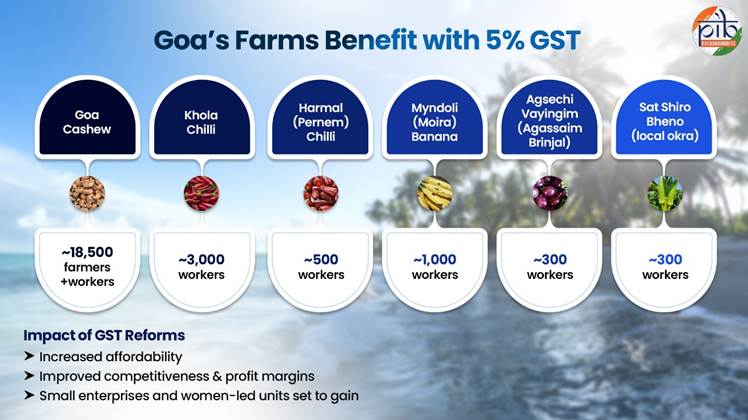

Goa Cashew

The Goa Cashew industry, spread across Sattari, Bicholim, Quepem, and Sanguem processing clusters, benefits from the GST reduction on kernels and value-added products, with rates on some nuts and confectionery lowered from 12%/ 18% to 5%. The sector employs around 18,500 people, including farmers, cashew pickers, nut shellers (predominately women) and processors, with many families dependent on seasonal wage cycles. The industry serves both domestic retail and export markets, including UAE, USA, and EU.

The GST reform reduces costs, making Goan cashew products more competitive. Value-added items using inputs taxed at 18% now moved to 5%, such as chocolates and coffee-based preparations, are expected to see a retail price drop by around 11%. Also, items such as fruit or nut paste previously taxed at 12% may become cheaper by approximately 6.25%, improving affordability and margins.

Goa Cashew Feni

Goa’s GI-tagged Cashew Feni, holds both cultural and economic significance in the state. The production is primarily concentrated in Cuncolim, Sanvordem, and Quepem, where toddy tappers, small-scale distillers, and bottlers sustain this craft.

Although alcohol is excluded from GST, the industry benefits from the reduction in tax on packaging materials. This is expected to directly benefit around 2,000 people employed in the packaging segment of the industry. GST reduced from 18% to 5%, is expected to make packaging costs around 11% lower.

While the drink is mostly sold within Goa subject to state excise, the reduced cost of packaging inputs is expected to improve profitability and support small distillers and local enterprises that contribute to Goa’s unique Feni ecosystem.

Khola Chilli

The Khola Chilli, is a GI-tagged product cultivated and processed in spice markets & cottage sauce units of Canacona (Khola). The sector includes smallholder farmers, spice grinders, and cottage-industry processors, employing around 1,000 families, or approximately 3,000 people. The product primarily serves domestic gourmet retail markets and diaspora stores abroad.

The raw Khola chilli, sold as an agricultural produce, remains exempt from GST. Under new reforms, GST on processed products like sauces and pickles is reduced from 18% to 5%. This is expected to bring shelf prices down by about 11%. The tax reduction will enhance competitiveness, expand market reach, and improve profit margins.

Harmal (Pernem) Chilli

The GI-tagged Harmal (Pernem) Chilli, cultivated in the Harmal-Arambol region of Pernem, forms part of Goa’s spice and sauce value chain. The sector employs around 500 people consisting of smallholder farmers, spice grinders, and cottage-industry processors.

The product is sold through specialty retailers and online platforms. With GST on processed spice products reduced from 18% to 5%, the cost is estimated to reduce by about 11%. This rate change lowers production and retail costs for small-scale processors, enabling better market competitiveness and improved affordability.

Myndoli (Moira) Banana

The Myndoli (Moira) Banana, cultivated in Moira (Bardez) and nearby areas, is a GI-tagged agricultural product used to make banana chips and sweets. With around 1,000 people engaged in its farming, the sector involves orchardists, women-led snack-making units, and chip units.

The primary market includes tourist retail outlets and online platforms. The new 5% GST rate, is expected to bring prices of packaged banana-based products by approximately 6.25%. The rate cut supports small enterprises and women-led units engaged in preserving this regional specialty.

Agsechi Vayingim (Agassaim Brinjal)

The Agsechi Vayingim (Agassaim Brinjal), grown in Agassaim (Tiswadi) is a GI-tagged produce used to make pickles and sauces. The sector involves kitchen-garden farmers and women-led SHGs engaged in making pickles and dehydrated mixes. The sector employs around 300 people, catering mainly to niche gourmet retail markets.

With the GST rate on processed products reduced from 18% to 5%, the price of pickles and sauces is expected to fall by about 11%, benefiting small producers and improving competitiveness in local markets.

Sat Shiro Bheno (local okra)

Goa’s local okra variety, Sat Shiro Bheno is cultivated in Tiswadi and Bardez kitchen gardens and peri-urban farms. The sector employs around 300 people, supporting small-scale farmers and women-led SHGs.

The product is mainly sold through domestic specialty stores and online platforms. With GST on processed variants reduced from 18%/ 12% to 5%, prices are expected to drop by about 6.25%, lowering input costs and improving profitability for small producers.

Conclusion

The GST reforms are poised to impact Goa’s diverse economy, touching nearly every productive sector, from pharmaceuticals and fisheries to tourism, construction and agriculture. By rationalizing tax rates, the reforms have created cost savings across industries, enhancing competitiveness and stimulating consumption.

Collectively, these changes not only bring price relief for consumers but also foster growth across rural and urban industries. As one of India’s most tourism-driven states, Goa’s economy is expected to gain significantly from GST 2.0.