GST Reforms 2025: How Maharashtra’s Economy Will Gain Across Sectors

GST Reforms 2025: How Maharashtra’s Economy Will Gain Across Sectors

Key Takeaways

Introduction

Introduction

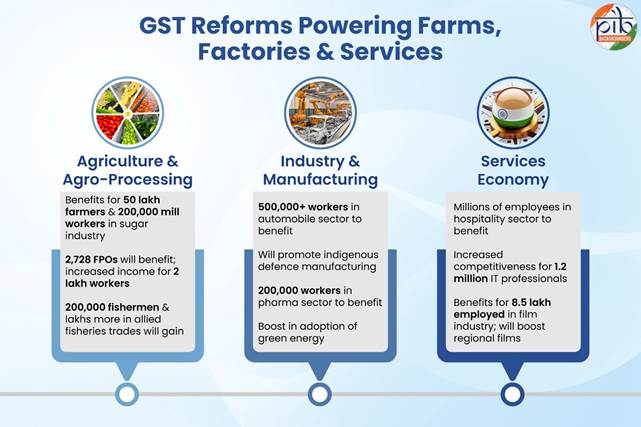

An economy with strong agriculture, industry, and services sectors, Maharashtra is set to gain significantly from the recent GST reforms. The state’s economy entails sugar production in its western belt, fruit and vegetable processing in Nagpur, Nashik, Jalgaon, and Konkan, and fisheries along the coastal districts. It is equally recognised for its handloom hubs like Ichalkaranji and Solapur, iconic crafts such as Kolhapuri chappals, Warli paintings, and Paithani sarees, as well as industrial clusters in automobiles, defence, and pharmaceuticals.

The reforms bring GST reductions across these sectors, lowering rates and bringing relief to consumers. By cutting costs and enhancing competitiveness, the changes directly support farmers, artisans, workers, and professionals. The new structure ensures affordability for consumers while strengthening Maharashtra’s economy.

Agriculture & Agro-processing

Sugar Industry

Maharashtra’s Sugar Belt in the western districts covers Kolhapur, Sangli, Satara, Pune, Solapur and Ahmednagar. It is India’s largest sugar producer and accounts for ~35-40% of the country’s total output. The industry provides direct employment to over 200,000 workers in more than 200 sugar mills and supports the livelihoods of an estimated 50 lakh sugarcane farmers.

The revised GST rate from 12% to 5% on refined sugar will make sugar ~6-7% cheaper at the wholesale level. This will lower input costs for a vast food processing industry (confectionery, beverages) and reduce household grocery bills.

Processed Foods (Fruits & Vegetables)

The food processing sector in Maharashtra has received a boost through the reduction of GST on processed fruit products. GST rate on fruit juices, jams, jellies, and sauces is reduced from 12% to 5%. This change directly benefits Maharashtra’s horticultural belts, such as, Nagpur for oranges, Nashik for grapes, onions, and tomatoes, Jalgaon for bananas, and the Konkan region renowned for mangoes. The industry has 2,728 registered food processing units (FPUs) and provides employment to around 2 lakh people, accounting for 13% of India’s workforce in the food processing sector. In terms of trade, the state’s contribution to India’s agricultural and food product exports during 2022-23 stood at 17.64% of India’s total.

The GST rate cut will lower the cost of processed food products by ~6-7%. This is expected to encourage higher consumption, promote value addition, and increase the offtake of produce from farmers across the horticultural belts of the state.

Fisheries & Marine Processing

Maharashtra’s long coastline makes it a major marine fish producer in the country. The fisheries and marine processing sector is a significant traditional industry along the Konkan Coast, spanning Mumbai, Raigad, Ratnagiri, and Sindhudurg districts. It has long been the primary livelihood for the Koli community and other coastal populations, providing employment to over 200,000 active fishermen and supports lakhs more in allied services, such as, processing, transport, and retail.

Beyond meeting domestic demand, the industry also contributes to global seafood trade. Processed fish and shrimp from Maharashtra are exported to international markets, particularly the EU, Japan, and Southeast Asia.

The reduction of GST on prepared and preserved fish products from 12% to 5% will support seafood processing MSMEs across the coastal belt. This will make products more competitive in both domestic and international markets.

Handlooms & Handicrafts

Cotton & Textile Industry

The cotton and textile industry is an important sector in Maharashtra, with a strong presence across multiple regions. Major textile hubs include Ichalkaranji, often called the “Manchester of Maharashtra”, Solapur, known for its towels and bedsheets, as well as Malegaon and Bhiwandi, both significant weaving and processing centres. In addition, the cotton-growing regions of Vidarbha, particularly Yavatmal and Amravati, along with parts of Marathwada, are also key hubs for the sector.

The textile sector is the second-largest employer in Maharashtra, providing livelihoods to over 1.1 million people in spinning, weaving, and garmenting. It supports millions of people, from cotton farmers in Vidarbha to power loom workers and small-scale processors in the textile towns. Maharashtra is among India’s leading textile states and plays a critical role in yarn and fabric production. Solapur alone has a home textile market with an estimated turnover of over ₹15,000 crore.

The GST rate cut on yarn and fabrics from 12% to 5% is expected to reduce input costs for garment and home textile manufacturers by ~6-7%. This will directly enhance the competitiveness of Maharashtra’s power loom sector.

Kolhapuri Chappals & Leather Goods

Kolhapuri chappals and leather goods industry is concentrated in Kolhapur, parts of Sangli, and the leather processing cluster in Dharavi, Mumbai. This GI-tagged craft is a traditional livelihood for artisan families, primarily from marginalized communities, who have been handcrafting these unique chappals for generations. The sector provides direct employment to over 30,000 artisans within the Kolhapur cluster. In addition, the Dharavi leather industry employs over 15,000 people.

These handcrafted products are widely sold across India and also exported to countries such as the USA, Australia, and the UK. The revised 5% GST rate on footwear priced at or below ₹2,500 per pair and on leather, is expected to directly benefit this industry. For instance, a typical pair of Kolhapuri chappals, usually priced between ₹800 and ₹2,000, will now become approximately 6-7% cheaper. This reduction will make the craft more affordable and competitive in markets, providing a boost to artisan sales.

Warli Paintings & Folk Art

Warli paintings and folk art are rooted in the Palghar district and surrounding tribal areas in the Sahyadri ranges. This traditional art form provides a livelihood for hundreds of artisan families, particularly from the Warli community. Known for its minimalistic and captivating style, this art form art form is sold on canvases, apparel, and home décor items. This wide appeal has helped sustain demand for authentic, hand-painted works created by artisans in the region.

The reduction of GST on paintings executed by hand from 12% to 5% will bring a measurable impact. Authentic Warli paintings are expected to become ~6-7% cheaper. This change will allow artisans to compete more effectively with mass-produced prints while also helping them earn a better livelihood from their ancestral craft.

Paithani Sarees

Paithani sarees are among the most iconic handwoven textiles of Maharashtra. The craft of weaving these sarees is a highly skilled, traditional practice that has been passed down through generations of weaver families. The weaving clusters in Paithan and Yeola provide employment to several thousand weaver families.

It holds a unique position in the market as a premium, high-value product with a single Paithani saree ranging in cost from ₹15,000 to over ₹5 lakh. With a strong cultural significance these sarees considered an essential attire for Maharashtrian weddings.

With GST on key inputs like silk/zari thread reduced from 12% to 5%, the production cost will fall for weavers. This provides them with better margins or the flexibility to price their creations more competitively.

Automotive & Auto Ancillary Hub

The automotive and auto ancillary sector in Maharashtra has a strong base across the Pune-Chakan-Talegaon belt, Aurangabad, and Nashik. This is a high-skill sector employing engineers, ITI graduates, and a vast number of assembly line workers. The Pune automotive cluster is one of the largest in India, providing direct and indirect employment to over 500,000 people.

The sector not only accounts for a significant portion of India’s automobile and auto component manufacturing but has also supported urbanization and economic growth in Maharashtra. It is also a major export hub, contributing over 25% of India’s total auto exports.

The recent GST rate cuts from 28% to 18% include a reduction on auto parts, motorcycles under 350cc and small cars. For large cars, the compensation cess has been removed, further impacting prices in this category. The revised rates are expected to lower the cost of vehicles and spare parts significantly. A car priced at ₹10 lakh, for example, could become cheaper by ₹90,000 to ₹1 lakh, while the cost of parts for servicing will also decrease. This will result in increased demand across the sector.

New Economy & Strategic Industry

Defence Manufacturing

Defence manufacturing has emerged as an important sector in Maharashtra, with key hubs in Nagpur which forms part of the Defence Corridor, Pune, Ahmednagar housing the Combat Vehicles Research and Development Establishment (CVRDE), and Nashik as the base of Hindustan Aeronautics Limited (HAL).

Together, these centres represent a growing network of strategic, high-technology sector employing skilled engineers, researchers, and technicians, fostering a domestic defence industrial base. With a dedicated defence industrial corridor, Maharashtra is poised to become a key hub for manufacturing ammunition, vehicles, and aerospace components for the Indian Armed Forces. Employment is expanding steadily, with major public and private players such as Ordnance Factories, L&T Defence, and Bharat Forge setting up facilities in the state.

The revised 5% GST on armoured vehicles along with IGST exemption on critical components, will lower procurement costs for the Ministry of Defence. These measures are expected to encourage greater indigenous manufacturing under the “Make in India” initiative.

Renewable Energy Devices

Renewable energy devices form a growing sector across Maharashtra, with focus concentrated in regions such as Vidarbha and Marathwada, which receive high solar radiation. Maharashtra is one of the leading states in renewable energy capacity in India, and policies such as the PM-KUSUM scheme for solar pumps have gained strong popularity among farmers in rural areas. With promotion of clean energy solutions among both farmers and households, the sector contributes to energy security and environmental goals.

The GST reduction to 5% will make solar panels, solar water heaters, and other renewable devices ~6-7% cheaper. This cost benefit is expected to accelerate adoption, supporting government green energy targets and reducing reliance on conventional power sources.

Pharmaceutical Industry

The pharmaceutical industry in Maharashtra is spread across key centres such as Mumbai, Pune, Aurangabad, and Tarapur. It is a leading state in the pharmaceutical sector employing over 2 lakh people including pharmacists, scientists, and a skilled manufacturing workforce. Maharashtra is a major contributor to pharmaceutical production in India as well as a key export hub.

The recent GST rate change on medicaments, reduced from 12% to 5%, is expected to have a direct impact on consumers. Medicines will now be around 6-7% cheaper. This will reduce healthcare expenses and bring relief to households, especially for families dealing with chronic ailments that require long-term medication.

Financial Services & Insurance

The financial services and insurance sector is a high-value service industry that employs finance professionals, insurance agents, and tech experts. Employment in this sector is significant with the BFSI industry being one of the largest white-collar employers in Mumbai and Pune.

The new GST reforms bring a major shift for the insurance sector. With GST exemption on individual health and life insurance policies, the cost of premiums has reduced significantly for consumers. For example, a health insurance premium of ₹20,000 could become cheaper by ₹3,600. With this exemption, insurance will be more affordable, increasing penetration and enhancing social security amongst citizens.

Hospitality & Tourism Sector

Maharashtra stands among the top states in the country for tourist arrivals, catering to both domestic and international travellers. Its hospitality and tourism sector is spread across Mumbai, Pune, Aurangabad with its Ajanta-Ellora caves, Nashik, and the Konkan coastal belt covering Alibag, Ratnagiri, and Sindhudurg. The sector serves as a massive service industry that supports millions of livelihoods by employing people at all skill levels, ranging from hotel management professionals to housekeeping and restaurant staff.

The new GST rates have a direct impact on affordability. The rate on hotel accommodation priced at ₹7,500 or below has been reduced from 12% to 5% without input tax credit. For instance, a room priced at ₹6,000 per night will see the tax component drop from ₹720 to ₹300, hence, saving ₹420 per night. This will make stays cheaper for tourists and business travellers.

Film & Entertainment Industry

Mumbai is the undisputed centre of the Indian film industry. Home to Bollywood, this sector supports a diverse range of professionals, from actors and directors to thousands of technicians, crew members, and daily wage earners. Employment generated by this industry is vast, with more than 8.5 lakh people in Mumbai dependent on it for their livelihoods.

India has the highest cinema attendance in the world, and affordable access to films plays an important role in sustaining this demand. With recent GST change, the tax on cinema admission tickets priced at ₹100 or less has been reduced from 12% to 5%. This measure is targeted at the mass-market audience that primarily frequents single-screen theatres and smaller multiplexes. Lower ticket prices are expected to reduce costs for the common person, making cinema more accessible. The potential increase in footfalls will also support the exhibition sector, primarily benefitting regional and low-budget films.

IT & ITES Export Services

The IT and ITES hubs in Maharashtra are centred around Pune’s Hinjawadi and Magarpatta, Mumbai’s Thane-Belapur and Navi Mumbai belts, and Nagpur. The sector is a major white-collar employer, providing jobs to IT professionals, engineers, and graduates, and plays a central role in driving the service economy of these cities. Maharashtra’s IT sector employs over 1.2 million professionals and accounts for more than 20% of India’s total software exports.

The recent amendment to the place of supply rules for “intermediary services” marks a landmark change. This will allow thousands of IT/ITES companies in Maharashtra to classify their services as exports and claim GST refunds, significantly boosting their cash flow and global competitiveness.

Conclusion

The new GST reforms are set to benefit Maharashtra’s economy that span agriculture, industry, and services. By easing tax burdens, the reforms lower costs for consumers while strengthening margins for producers, creating a balance between affordability and competitiveness.

For Maharashtra, where diverse sectors contribute to growth and employment, these reforms act as a unifying force that strengthens economic linkages and widens opportunities.