Highlights of Telecom Subscription Data as on 31st May 2025

Highlights of Telecom Subscription Data as on 31st May 2025

Particulars

Wireless*

Wireline

Total

(Wireless+

Wireline)

Broadband Subscribers (Million)

930.77

44.09

974.87

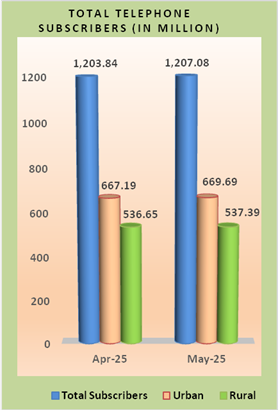

Urban Telephone Subscribers (Million)

634.91

34.78

669.69

Net Addition in May 2025 (Million)

1.61

0.88

2.50

Monthly Growth Rate

0.25%

2.60%

0.37%

Rural Telephone Subscribers (Million)

533.51

3.88

537.39

Net Addition in May 2025 (Million)

0.38

0.37

0.74

Monthly Growth Rate

0.07%

10.44%

0.14%

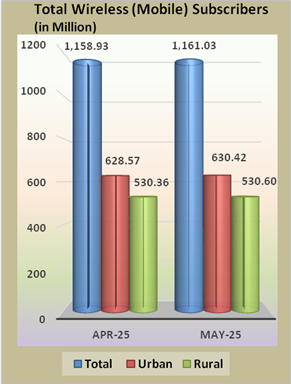

Total Telephone Subscribers (Million)

1168.42

38.66

1207.08

Net Addition in May, 2025 (Million)

1.99

1.25

3.24

Monthly Growth Rate

0.17%

3.34%

0.27%

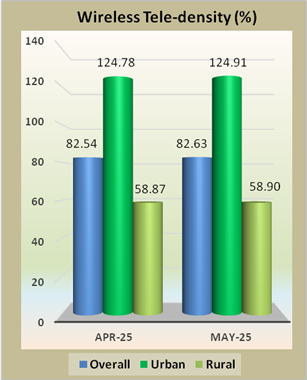

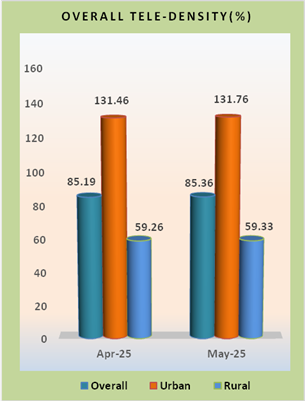

Overall Tele-density@

82.63%

2.73%

85.36%

Urban Tele-density@

124.91%

6.84%

131.76%

Rural Tele-density@

58.90%

0.43%

59.33%

Share of Urban Subscribers

54.34%

89.97%

55.48%

Share of Rural Subscribers

45.66%

10.03%

44.52%

____________________________________________________________________________________________________________________________________________________

Note:

* Wireless includes 5G FWA subscription also.

@ Based on the projection of population from the ‘Report of the Technical Group on Population Projections for India and States 2011 – 2036’.

$ VLR is acronym of Visitor Location Register. The dates of peak VLR for various telecom service providers (TSPs) are different in different service areas.

Information in this Press Release is based on the data provided by the TSPs to TRAI.

# M/s Reliance Jio Infocomm Limited has reported 1.03 million Fixed Wireless Access – Unlicensed Band Radio (FWA-UBR) subscribers in FTTx category as on 31st May 2025.

Segment–wise Broadband Subscribers and Monthly Growth Rate

in the Month of May 2025

Segment

Subscription

Subscribers

(in million)

Percent Change*

Apr-2025

May-2025

Wired Subscribers

Fixed Wired Broadband

(DSL, FTTx, Ethernet/LAN, Cable Modem, ILL)

41.41

44.09

6.46%

Wireless Subscribers

Fixed Wireless Broadband

(5G FWA, Wi-Fi, Wi-Max, Radio, Satellite)

4.87

7.79

60.06%

Mobile Broadband

(Handset/Dongle based)

896.81

922.99

2.92%

Total Broadband Subscribers

943.09

974.87

3.37%

* The report of broadband subscribers for the month of April 2025 was prepared by considering the internet subscription data for the month of November 2024 submitted by M/s Reliance Jio Infocomm Limited and M/s Bharti Airtel Limited as these service providers did not submit the internet subscription data in the prescribed format for the month of December 2024, January 2025, February 2025, March 2025 and April 2025. M/s Reliance Jio Infocomm Limited and M/s Bharti Airtel Limited have started submitting the required data in the prescribed format from the month of May 2025. For this reason, the above table depicts a significant change in the number of broadband subscribers in the month of May 2025.

Top five Broadband

(Wired + Wireless) Service Providers as on 31st May 2025

S.N.

Name of the Service Provider

Subscriber base

(In million)

Reliance Jio Infocomm Ltd.

494.47

Bharti Airtel Ltd.

302.15

Vodafone Idea Ltd.

126.68

Bharat Sanchar Nigam Ltd.

34.32

Atria Convergence Technologies Ltd.

2.32

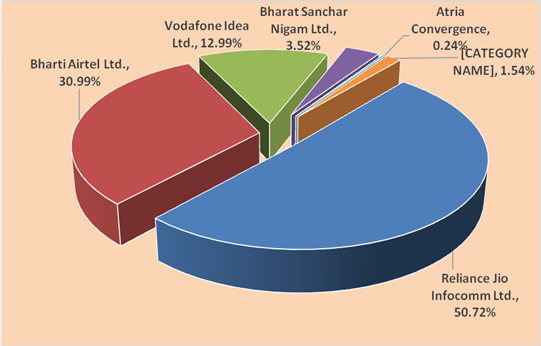

Market Share of Top Five Broadband (Wired+Wireless)

98.47%

Service Provider-wise Market Share of Broadband (wired + wireless) Services as on 31st May 2025

Top Five Fixed Wired Broadband Service providers as on 31st May 2025

S.N.

Name of the Service Provider

Subscriber base

(In million)

Reliance Jio Infocomm Ltd.

13.51

Bharti Airtel Ltd.

9.26

Bharat Sanchar Nigam Ltd

4.32

Atria Convergence Technologies Ltd.

2.32

Kerala Vision Broadband Ltd.

1.34

Market Share of Top Five Fixed Wired Broadband Service Providers

69.74%

Top five Wireless Broadband (Fixed Wireless Broadband + Mobile Broadband)

Service providers as on 31st May 2025,

S.N.

Name of the Service Provider

Subscriber base

(In million)

Reliance Jio Infocomm Ltd.

480.96

Bharti Airtel Ltd.

292.89

Vodafone Idea Ltd.

126.67

Bharat Sanchar Nigam Ltd..

29.99

IBus Virtual Network Services Private Limited

0.09

Market Share of Top Five Wireless Broadband Service Providers

99.98%

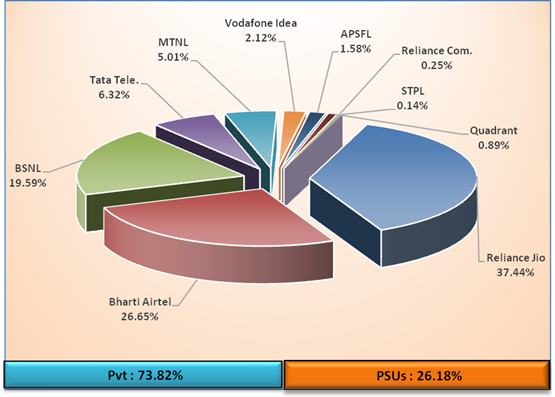

Access Service Provider-wise Market Share of Wireline Subscribers

as on 31st May 2025

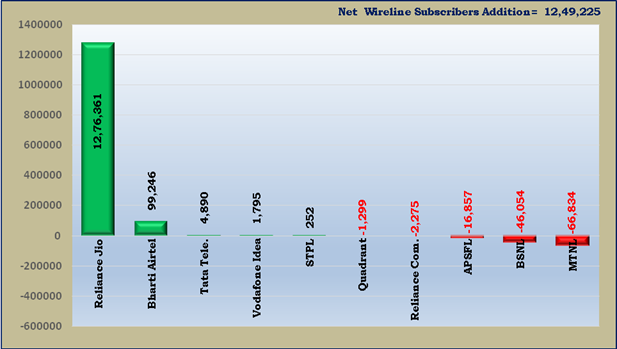

Access Service Provider wise Net Addition/Decline in Wireline Subscribers During the Month of May 2025

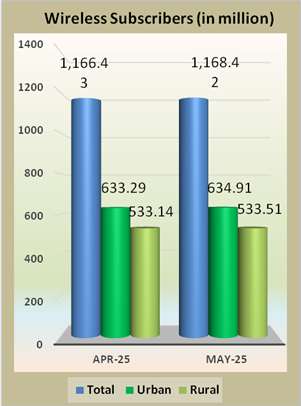

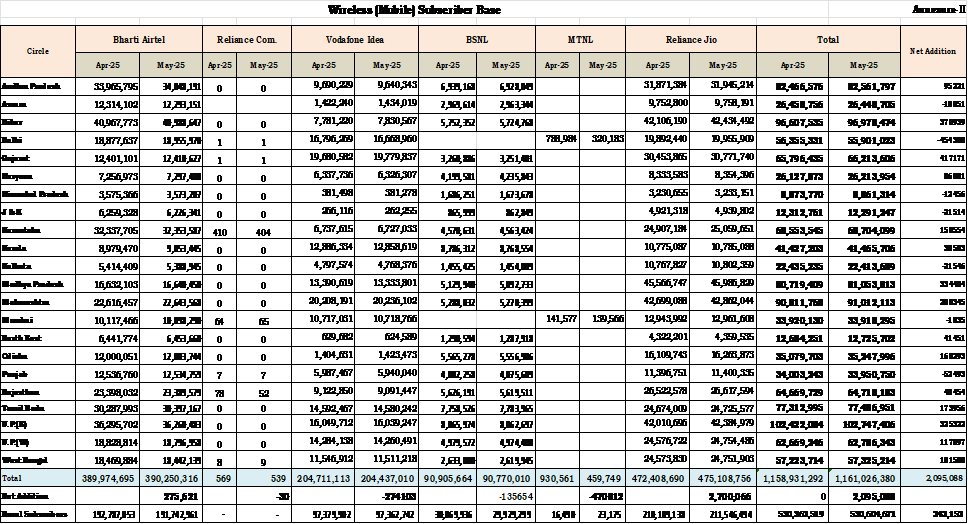

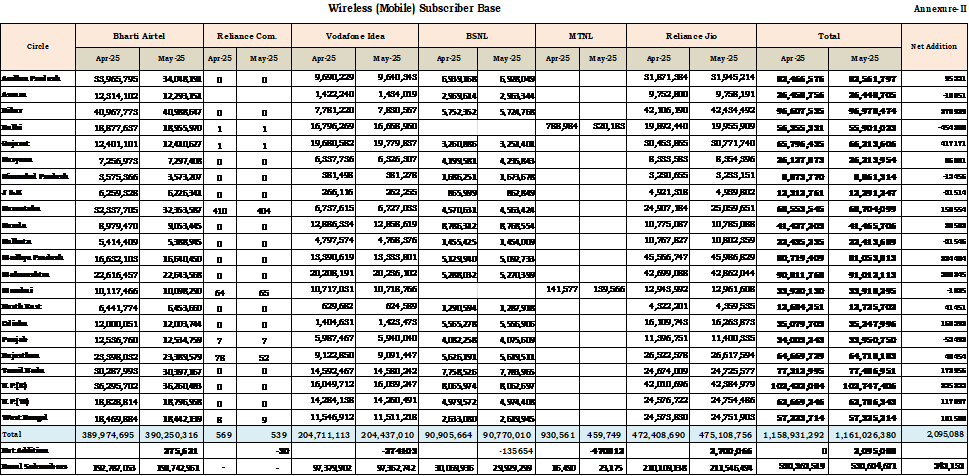

(A) Wireless (Mobile) Subscriber Base

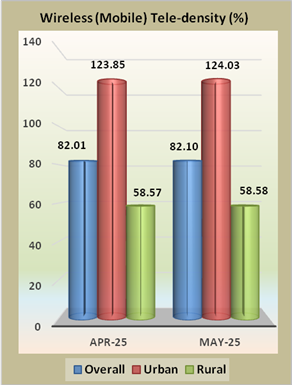

The wireless (mobile) tele-density in India increased from 82.01% at the end of April 2025 to 82.10% at the end of May 2025. The urban wireless tele-density increased from 123.85% at the end of April 2025 to 124.03% at the end of May 2025 and rural tele-density increased from 58.57% to 58.58% during the same period. The share of urban and rural wireless (mobile) subscribers in total number of wireless (mobile) subscribers was 54.30% and 45.70% respectively at the end of May 2025.

Detailed statistics of wireless (mobile) subscriber base is available at Annexure-II.

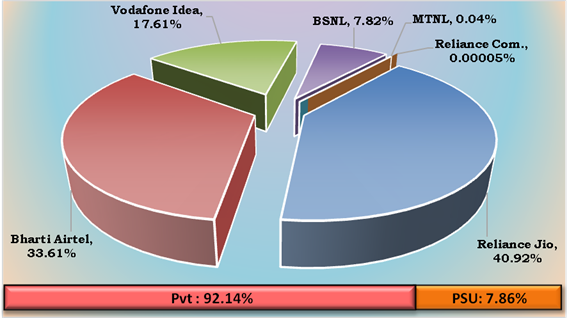

• As on 31st May 2025, the private access service providers held 92.14% market share of the wireless (mobile) subscriber base, whereas BSNL and MTNL, the two PSU access service providers, had a market share of 7.86%.

Access Service Provider-wise Market Shares of Wireless (Mobile) Subscribers as on 31st May 2025

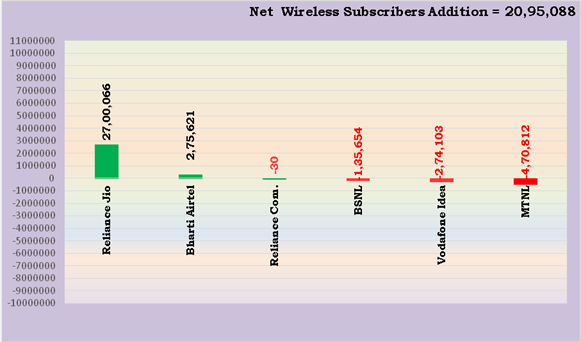

Net Addition/ Decline in Wireless (Mobile) Subscribers of

Access Service Providers in the month of May 2025

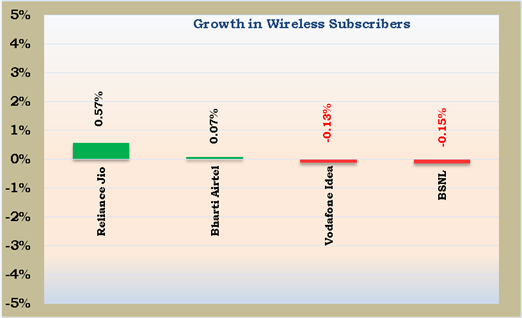

Growth in Wireless (Mobile) Subscribers

Major Access Service Provider-wise Monthly Growth/ Decline Rate of Wireless Subscribers in the month of May 2025

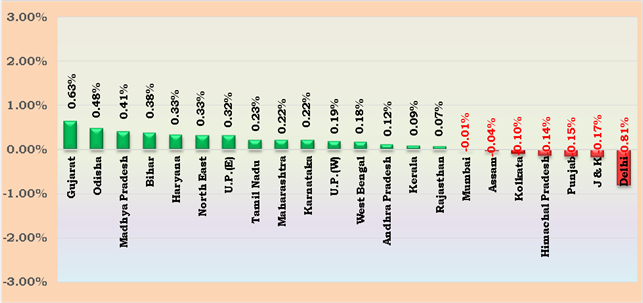

Service Area-wise Monthly Growth/ Decline Rate of Wireless (Mobile) Subscribers in the month of May 2025

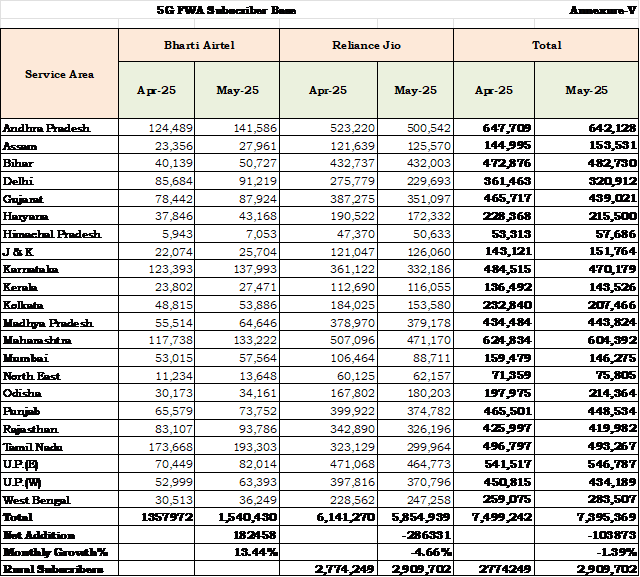

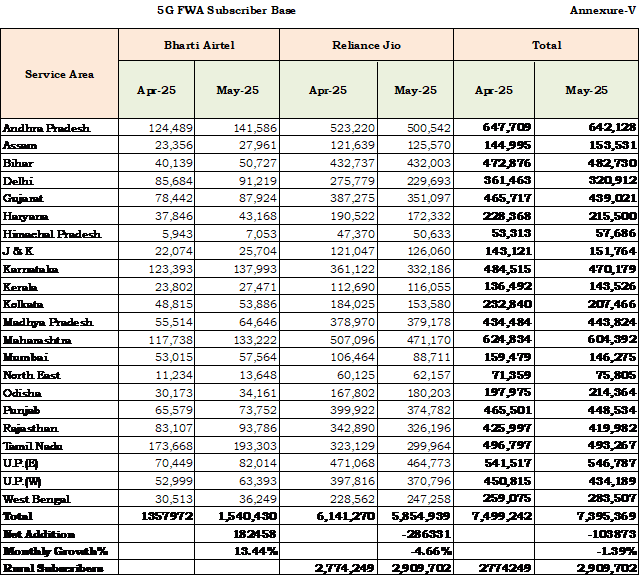

(B) Wireless (5G FWA) Subscriber Base

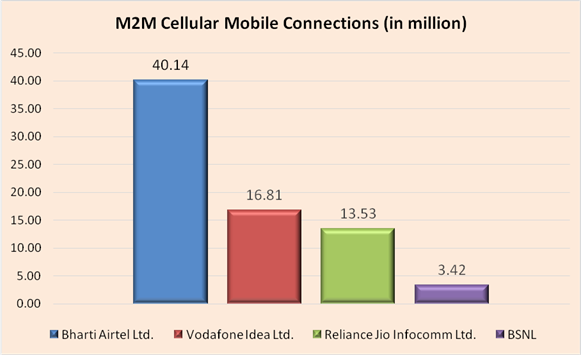

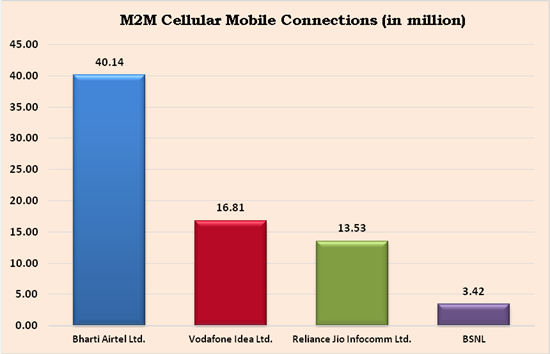

The number of M2M cellular mobile connections increased from 69.87 million at the end of April 2025 to 73.91 million at the end of May 2025.

Bharti Airtel Limited has the highest number of M2M cellular mobile connections of 40.14 million with a market share of 54.31%, followed by Vodafone idea Limited, Reliance Jio Infocom Limited and BSNL with market share of 22.74%, 18.31% and 4.63% respectively.

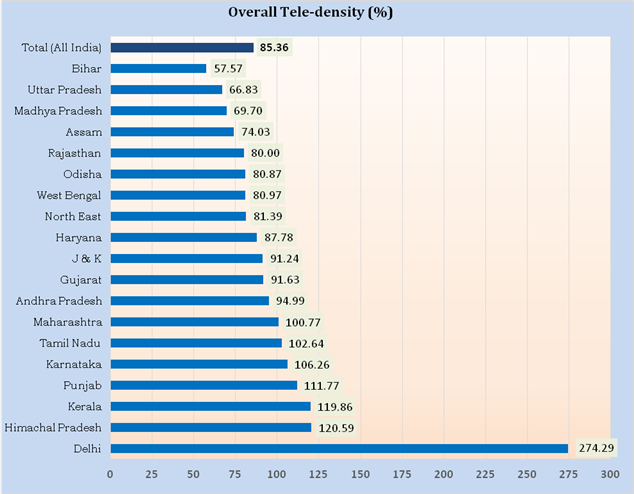

Overall Tele-density (LSA Wise) as on 31st May 2025

Notes: –

Circle Category-wise Net Additions in Telephone Subscribers in the Month of May 2025

Circle

Category

Net additions in the month of May 2025

Telephone Subscriber base as on 31st May 2025

Wireline segment

Wireless* segment

Wireline segment

Wireless* segment

Circle A

461,410

966,662

15,152,689

388,627,553

Circle B

518,781

992,468

10,845,406

473,197,218

Circle C

153,940

588,903

3,158,931

193,689,318

Metro

115,094

-556,818

9,503,153

112,907,660

All India

1,249,225

1,991,215

38,660,179

1,168,421,749

*Wireless includes 5G FWA subscription also.

Circle Category-wise Monthly and Yearly Growth Rates in Telephone Subscribers in the month of May 2025

Circle Category

Monthly growth rate (%)

(April-25 to May-25)

Yearly growth rate (%)

(May-24 to May-25)

Wireline Segment

Wireless* Segment

Wireline Segment

Wireless* Segment

Circle A

3.14%

0.25%

12.04%

-0.02%

Circle B

5.02%

0.21%

15.95%

-0.47%

Circle C

5.12%

0.30%

14.39%

1.80%

Metro

1.23%

-0.49%

4.50%

-1.44%

All India

3.34%

0.17%

11.31%

-0.05%

*Wireless includes 5G FWA subscription also.

Note: Circle Category-Metro includes Delhi, Mumbai and Kolkata.

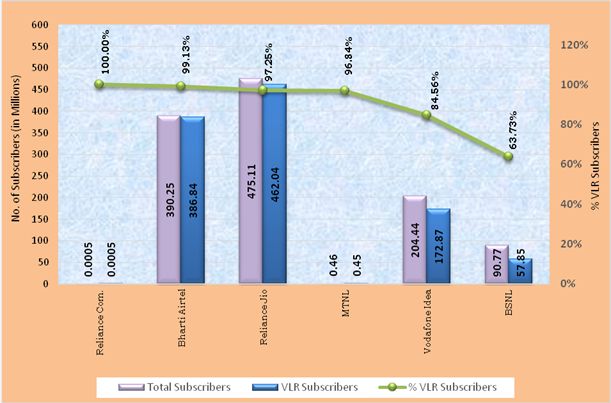

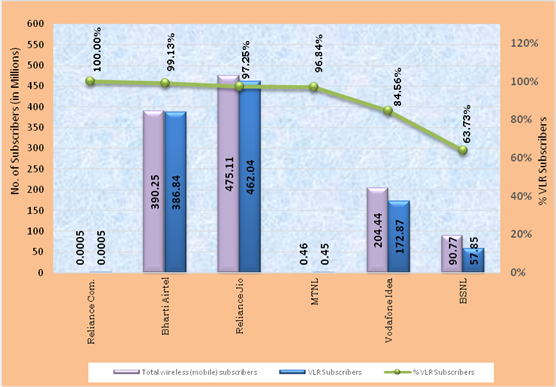

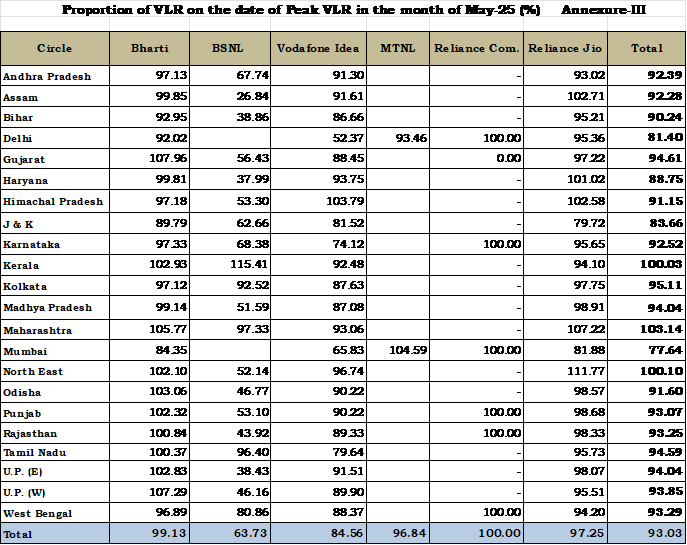

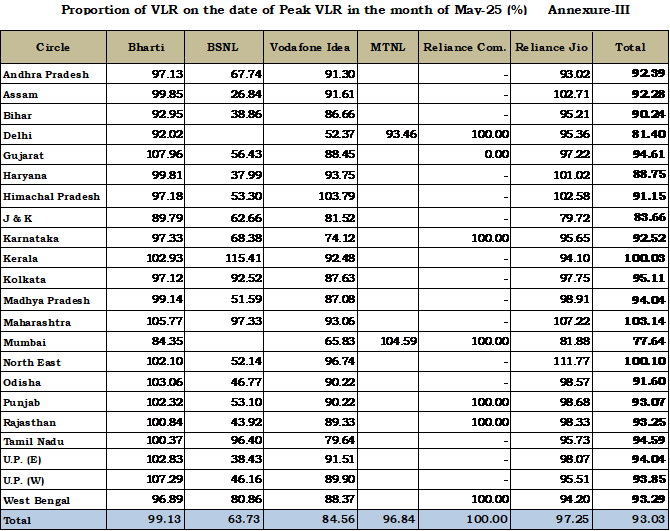

Access Service Provider-wise Percentage of VLR Subscribers

in the Month of May 2025

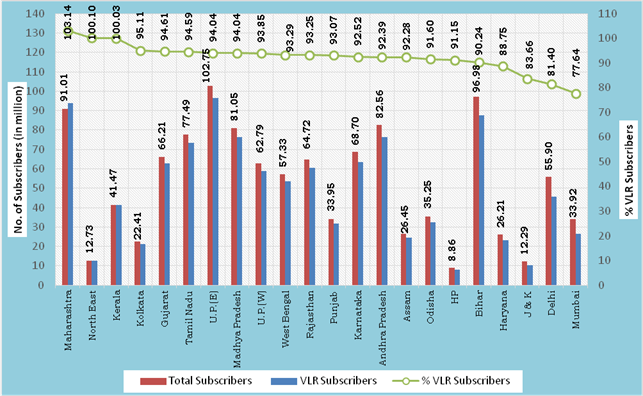

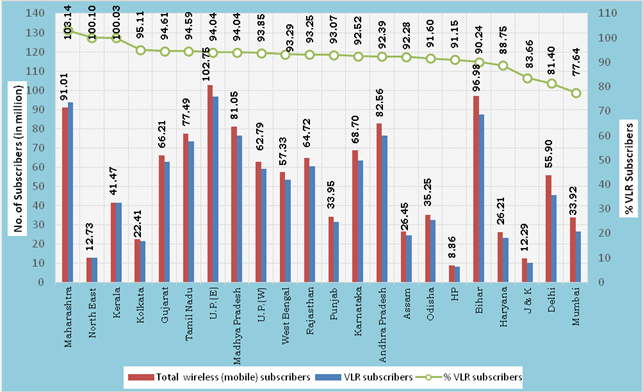

Service Area-wise Percentage of VLR Subscribers

in the Month of May 2025

Service Area Wise MNP Status

Zone-I

Zone–II

Service Area

Cumulative Number of Porting Requests Till (in Million)

Service Area

Cumulative Number of Porting Requests Till

(in Million)

Apr-25

May-25

Apr-25

May-25

Delhi

53.87

54.53

Andhra Pradesh

73.33

73.98

Gujarat

77.03

77.92

Assam

8.30

8.42

Haryana

35.58

35.99

Bihar

65.97

67.13

Himachal Pradesh

4.74

4.79

Karnataka

74.10

74.69

Jammu & Kashmir

3.30

3.38

Kerala

26.58

26.84

Maharashtra

91.80

92.72

Kolkata

20.36

20.55

Mumbai

36.50

36.74

Madhya Pradesh

89.58

90.83

Punjab

36.72

37.08

North East

2.58

2.61

Rajasthan

75.23

75.99

Odisha

19.70

19.93

U.P.(East)

113.81

115.77

Tamil Nadu

69.96

70.59

U.P.(West)

85.44

86.90

West Bengal

67.93

69.08

Total

614.03

621.81

Total

518.38

524.64

Total (Zone-I + Zone-II)

1,132.41

1,146.45

Net Addition (May 2025)

14.03 million

Contact details in case of any clarification: –

Shri Akhilesh Kumar Trivedi, Advisor (NSL-II),

Telecom Regulatory Authority of India

World Trade Centre, Tower-F,

Nauroji Nagar, New Delhi – 110029

Ph: 011-20907758 (Pushpendra Kumar Singh)

E-mail: advmn@trai.gov.in I/C Pr. Advisor (NSL), TRAI

Note: Peak VLR figures in some circles of some of the service providers are more than their HLR figures due to a large number of inroamers.

Annexure IV

VLR Subscribers in the Wireless Segment

Home Location Register (HLR) is a central database that contains details of each mobile phone subscriber that is authorized to use the GSM core network. The HLRs store details of every SIM card issued by the service provider. Each SIM has a unique identifier called an International Mobile Subscriber Identity (IMSI), which is the primary key to each HLR record. The HLR data is stored for as long as a subscriber remains with the service provider. HLR also manages the mobility of subscribers by means of updating their position in administrative areas. It sends the subscriber data to a Visitor Location Register (VLR).

Subscriber numbers reported by the service providers is the difference between the numbers of IMSI registered in service provider’s HLR and sum of other figures as given below: –

1

Total IMSI’s in HLR (A)

2

Less: (B = a + b + c + d + e)

a.

Test/Service Cards

b.

Employees

c.

Stock in hand/in Distribution Channels (Active Card)

d.

Subscriber Retention period expired

e.

Service suspended pending disconnection

3

Subscribers Base (A-B)

Visitor Location Register (VLR) is a temporary database of the subscribers who have roamed into the particular area, which it serves. Each base station in the network is served by exactly one VLR; hence a subscriber cannot be present in more than one VLR at a time.

If subscriber is in active stage i.e. he is able to send/receive calls/SMSs he is available both in HLR and VLR. However, it may be possible that the subscriber is registered in HLR but not in VLR due to the reason that he is either switched-off or moved out of coverage area, not reachable etc. In such circumstances he will be available in HLR but not in VLR. This causes difference between subscriber number reported by the service providers based on HLR and numbers available in VLR.

The VLR subscriber data calculated here is based on active subscribers in VLR on the date of Peak subscriber number in VLR of the particular month for which the data is being collected. This data is to be taken from the switches having the purge time of not more than 72 hours.

- Broadband Subscriber Base