Ministry of Finance Year Ender 2024: Department of Investment and Public Asset Management (DIPAM)

Ministry of Finance Year Ender 2024: Department of Investment and Public Asset Management (DIPAM)

In the year 2024, the Department of Investment and Public Asset Management (DIPAM) continued its focus on value creation for investors, strategic disinvestment, and efficient financial planning.

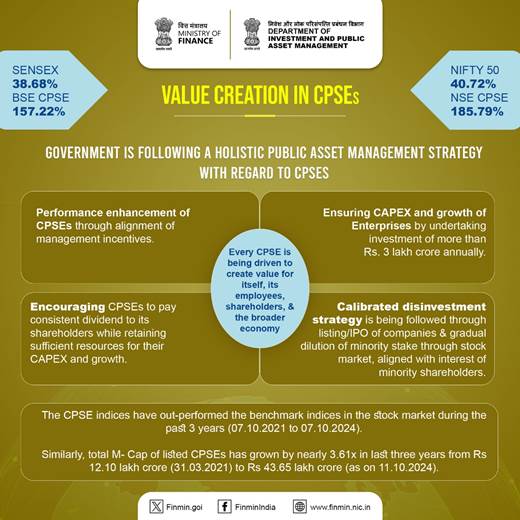

A key highlight in 2024 was the continued emphasis on value creation in Central Public Sector Enterprises (CPSEs). Since the introduction of the New PSE Policy in January 2021, the NSE CPSE and BSE CPSE Indices have demonstrated remarkable growth, showcasing returns of 182.36% and 146.92%, respectively, as of November 2024.

DIPAM successfully launched the Initial Public Offerings (IPOs) for key entities, including the Indian Renewable Energy Development Agency (IREDA) and MSTC Limited, which were met with strong investor response.

The DIPAM also used the Offer for Sale (OFS) route to create value for CPSEs like HAL, Coal India Limited, RVNL, SJVN Limited, and HUDCO, with the OFS collectively yielding Rs. 13,728 crore. The stocks involved continued to exhibit positive momentum post-OFS, reflecting investor confidence and contributing to capital gains.

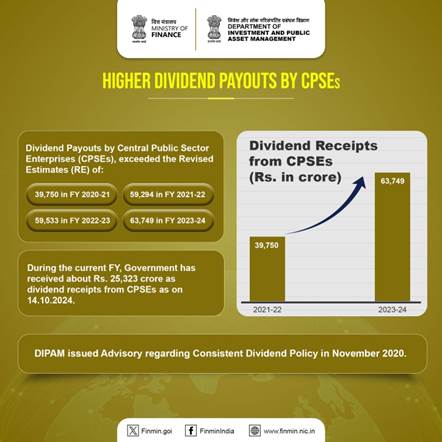

DIPAM has upheld its Consistent Dividend Policy, with total dividend receipts from CPSEs in FY 2023-24 reaching Rs. 67,895 crore, significantly exceeding the Revised Estimates. As of 5th December, 2024, the Government has realised Rs. 30,284 crore as dividend receipts from CPSEs for the current fiscal year.

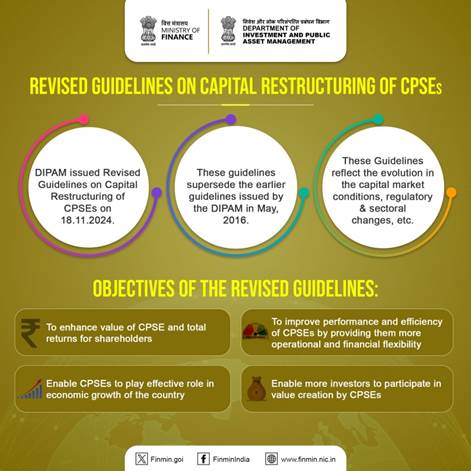

In step with the evolution in the capital market conditions, regulatory & sectoral changes, among others, DIPAM had issued revised Guidelines on Capital Restructuring of CPSEs in 2024. These guidelines supersede the earlier guidelines issued by the DIPAM in May, 2016.

Following are some of the major achievements of the Department of Investment and Public Asset Management (DIPAM), Ministry of Finance, in 2024:

GOVERNMENT IS FOLLOWING A HOLISTIC PUBLIC ASSET MANAGEMENT STRATEGY WITH REGARD TO CPSEs

DURING THE CURRENT FY, DIPAM HAS CARRIED OUT OFFER FOR SALE OF GENERAL INSURANCE CORPORATION OF INDIA.

OFFER FOR SALE (OFS) AND LISTING

COCHIN SHIPYARD LIMITED (CSL):

HINDUSTAN ZINC LIMITED (HZL):

LISTING OF NTPC GREEN ENERGY LTD. (NGEL):

STRATEGIC DISINVESTMENT OF FERRO SCRAP NIGAM LIMITED (FSNL)

HIGHER DIVIDEND PAYOUTS BY CPSEs

REVISED GUIDELINES ON CAPITAL RESTRUCTURING OF CPSES

OBJECTIVES OF THE REVISED GUIDELINES: